Indiana Gas Tax Reform Plan

A Plan to

Better Use Indiana Gasoline Tax Dollars

![]() Watchdog

Indiana Home Page

Watchdog

Indiana Home Page ![]() Watchdog

Lebanon Home Page

Watchdog

Lebanon Home Page

There is pressure building to increase the Indiana Gasoline Tax to provide more revenue for the construction and maintenance of our Indiana streets, roads, and highways. Similar pressure is also building for more counties to impose a Wheel Tax – 47 of 92 counties currently impose a Wheel Tax.

The Wheel Tax, which the state allows to be as much as $40 per vehicle per year, is a regressive tax. In a county that imposes the maximum Wheel Tax, a widow living on Social Security who only drives her 1994 Oldsmobile to church and the grocery store would pay the same $40 annual Wheel Tax as a well-to-do salesman who drives his 2012 Lexus a thousand miles a week.

The Indiana Gasoline Tax rate is 18 cents per gallon of gasoline (and gasohol). A driver’s Gasoline Tax burden increases when the miles driven increase.

Most Hoosiers mistakenly believe that all our Indiana Gasoline Tax dollars go to the construction and maintenance of our Indiana streets, roads, and highways. This is NOT true.

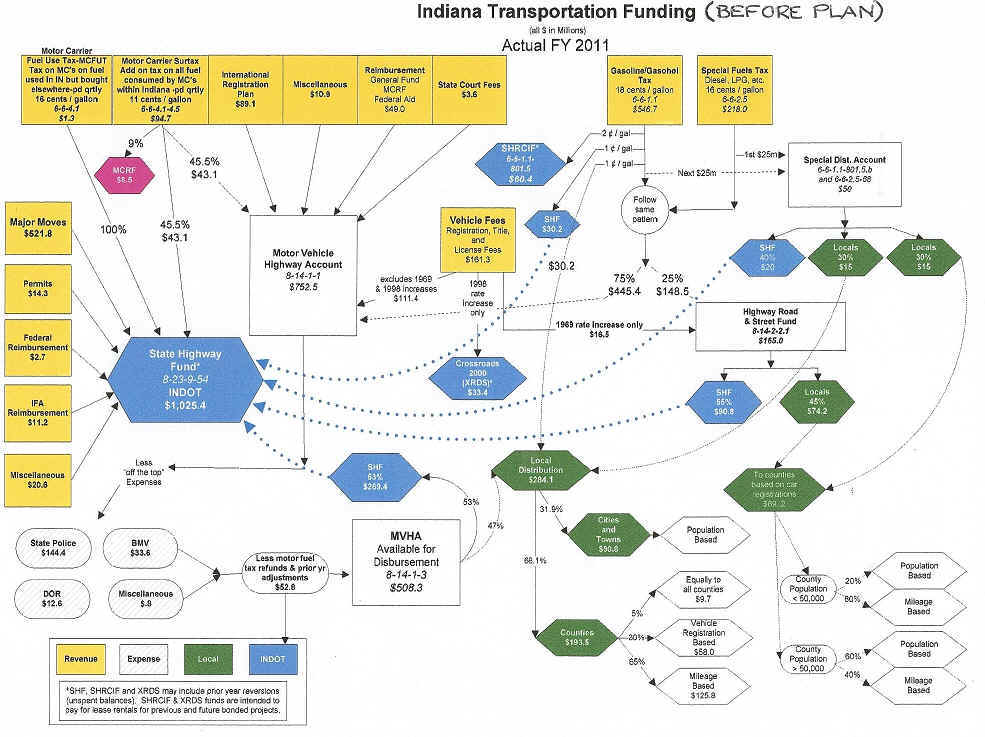

Only 71% of the $546.7 million in revenue from our 2011 Gasoline Tax dollars was dedicated directly to the construction and maintenance of our Indiana streets, roads, and highways without borrowing. Of the total Gasoline Tax rate of 18 cents per gallon, 6.7 cents (or $202.9 million) went to the State Highway Fund, 4.7 cents (or $143.3 million) went to our counties, and 1.4 cents (or $42.5 million) went to our cities and towns. Spending NOT directly related to the construction and maintenance of our Indiana streets, roads, and highways totaled 5.2 cents (or $158.0 million). Only 12.8 cents of our 18 cents per gallon Gasoline Tax is used today to meet our transportation needs.

The "Rube Goldberg" flow chart depicting Indiana transportation funding for fiscal year 2011 can be found following Page 273 of the Fiscal Year 2011 Indiana Handbook of Taxes, Revenues, and Appropriations, and this before-the-gas-tax-reform-plan flow chart is reproduced below.

The eight "Functional Categories" in the Indiana state budget are

General Government, Public Safety, Conservation and Environment, Economic

Development, Transportation, Health and Human Services, Education, and

Distributions. Of the 18 cents per gallon Gasoline Tax, 9.9 cents now go to the

Motor Vehicle Highway Account WITHIN the Transportation category. Some

appropriations are made from the Motor Vehicle Highway Account that go to

functional categories OUTSIDE the Transportation category. These

non-transportation appropriations are NOT properly available for the

construction and maintenance of our Indiana streets, roads, and highways.

Detailed next are the annual non-transportation appropriations from the Motor

Vehicle Highway Account contained in the current state budget (these annual

appropriations are identical for both the 2011-2012 and 2012-2013 fiscal years).

(1) The funding sources for the annual budgeted State Police appropriations are

listed next (see http://www.in.gov/sba/files/ap_2011_c_2_5_pub_saf_data.pdf).

$ 92,904,332 Motor Vehicle Highway Account

(54% of total)

$ 58,548,171 General Fund

$ 7,710,422 Federal Funds

$ 4,584,812 Motor Carrier Regulation Fund

$ 7,402,907 Other Dedicated Funds*

$171,150,644 STATE POLICE TOTAL

*Other Dedicated Funds include Accident Report Account ($25,500); Administration

Services Revolving ($1,125,916); Dedicated Airport Task Force Funds ($18,321);

Dedicated DNA Sample Processing Fund Funds ($1,327,777); Dedicated Excess

Handgun License Fees Funds ($2,904,256); Dedicated Fingerprint (FBI Print) Funds

($773,687); Dedicated Insurance Recovery Funds ($113,643); Dedicated ISP Youth

Education, Museum & Memorial Funds ($71,989); Dedicated Project Income/Grant

Funds ($80,994); Dedicated US Attorney General Forfeited Funds ($195,125); Drug

Interdiction ($215,000);

Fingerprint Identification ($1); Motor Vehicle Odometer ($50,000); and State

Police Training ($500,698).

(NOTE: When one visits the State Police website at http://www.in.gov/isp/,

it is apparent that our State Police operations involve much more than road

patrols. Our county Sheriff’s Departments are likewise involved with extensive crime prevention activities that are not

limited to road patrols. The budgets for Sheriff’s Departments do NOT take money away from our local street and highway

departments. It follows logically that our State Police budget should NOT be

considered part of transportation funding. Our State Police should NOT be mostly

funded through the Motor Vehicle Highway Account so more transportation

dollars will be properly available for the construction and maintenance of our Indiana streets, roads, and

highways.)

(2) The annual budgeted Bureau of Motor Vehicles appropriations from the

Motor Vehicle Highway Account total $40,149,403 (see http://www.in.gov/sba/files/ap_2011_c_2_5_pub_saf_data.pdf).

(3) The annual budgeted Department of Revenue appropriations from the Motor

Vehicle Highway Account total $9,682,918 (see http://www.in.gov/sba/files/ap_2011_c_1_5_gen_gov_data.pdf).

(4) The annual budgeted Miscellaneous appropriations from the Motor

Vehicle Highway Account are listed next (see http://www.in.gov/sba/files/ap_2011_c_2_5_pub_saf_data.pdf

and http://www.in.gov/sba/files/ap_2011_c_7_5_educ_data.pdf).

$589,701 Criminal Justice Institute

$252,483 School Traffic Safety

$842,184 MISCELLANEOUS TOTAL

The current annual budgeted grand total non-transportation

appropriations from the Motor Vehicle Highway Account are summarized as

listed next.

$ 92,904,332 State Police

$ 40,149,403 Bureau of Motor Vehicles

$ 9,682,918 Department of Revenue

$ 842,184 Miscellaneous

$143,578,837 GRAND TOTAL

Note: This grand total of $143.6 million of annual budgeted non-transportation appropriations from

the state’s Motor Vehicle Highway Account is different than the $191.4 million

indicated in the above Indiana Transportation Funding (Before Plan) flow chart.

The first component of the Indiana Gas Tax Reform Plan to better use our Indiana Gasoline Tax dollars is to move the annual budgeted non-transportation appropriations from the state’s Motor Vehicle Highway Account to the state General Fund.

The April 23, 2012, Indiana State Budget Agency Report of Fiscal Impact of Actions Taken During the 2012 Regular Session of the Indiana General Assembly estimates that on June 30, 2013, there will be a $1.6405 billion reserve balance in the state’s General Fund. Also, the state’s 2010-2011 General Fund reversions (state budgeted amounts not expended and returned to the state General Fund) totaled $1.1050 billion. We taxpayers have already provided ample enough funds to our state government that an amount equal to 13% of the 2010-2011 General Fund reversions can be properly used to move $143.6 million of annual budgeted non-transportation appropriations from the state’s Motor Vehicle Highway Account to the state General Fund.The second component of the Indiana Gas Tax Reform Plan is to make the changes listed next – indicated in blue

– in the Indiana Code statute for the Indiana Gasoline Tax.Indiana Code 6-6-1.1-801.5

Tax receipts; transfer to auditor; distribution

Sec. 801.5. (a) The administrator shall transfer one-ninth (1/9) of the

taxes that are collected under this chapter to the state highway road

construction and improvement fund.

(b) The administrator shall transfer one-eighteenth (1/18) of the taxes that are

collected under this chapter to the state highway fund.

(c) The administrator shall transfer one-eighteenth (1/18) of the taxes that are

collected under this chapter to the auditor of state for distribution to

counties, cities, and towns. The auditor of state shall distribute the amounts

transferred under this subsection to each of the counties, cities, and towns

eligible to receive a distribution from the motor vehicle highway account under

IC 8-14-1 and in the same proportion among the counties, cities, and towns as

funds are distributed from the motor vehicle highway account under IC 8-14-1.

Money distributed under this subsection may be used only for purposes that money

distributed from the motor vehicle highway account may be expended under IC

8-14-1.

(d) After the transfers required by subsections (a) through (c), the

administrator shall transfer the next one hundred

seventy-five million dollars ($175,000,000) of the taxes that

are collected under this chapter and received during a period beginning July 1

of a year and ending June 30 of the immediately succeeding year to the auditor

of state for distribution in the following manner:

(1) twenty-seven and one-half percent (27.5%)

to each of the counties, cities, and towns eligible to receive a distribution

from the local road and street account under IC 8-14-2 and in the same

proportion among the counties, cities, and towns as funds are distributed under

IC 8-14-2-4;

(2) sixty-two and one-half percent (62.5%)

to each of the counties, cities, and towns eligible to receive a distribution

from the motor vehicle highway account under IC 8-14-1 and in the same

proportion among the counties, cities, and towns as funds are distributed from

the motor vehicle highway account under IC 8-14-1; and

(3) ten percent (10%) to the

Indiana department of transportation.

(e) The auditor of state shall hold all amounts of collections received under

subsection (d) from the administrator that are made during a particular month

and shall distribute all of those amounts pursuant to subsection (d) on the

fifth day of the immediately succeeding month.

(f) All amounts distributed under subsection (d) may only be used for purposes

that money distributed from the motor vehicle highway account may be expended

under IC 8-14-1.

Indiana Code 6-6-1.1-802

Deposit of tax receipts

Sec. 802. The administrator shall, after the transfer specified in section

801.5 of this chapter, deposit the remainder of the revenues collected under

this chapter in the following manner:

(1) The taxes collected with respect to gasoline delivered to a taxable marine

facility shall be deposited in the fish and wildlife fund established by IC

14-22-3-2.

(2) Thirty-three percent (33%) of

the taxes collected under this chapter, except the taxes referred to in

subdivision (1), shall be deposited in the highway, road and street fund

established under IC 8-14-2-2.1.

(3) The remainder of the revenues collected under this chapter shall be

deposited in the motor fuel tax fund of the motor vehicle highway account.

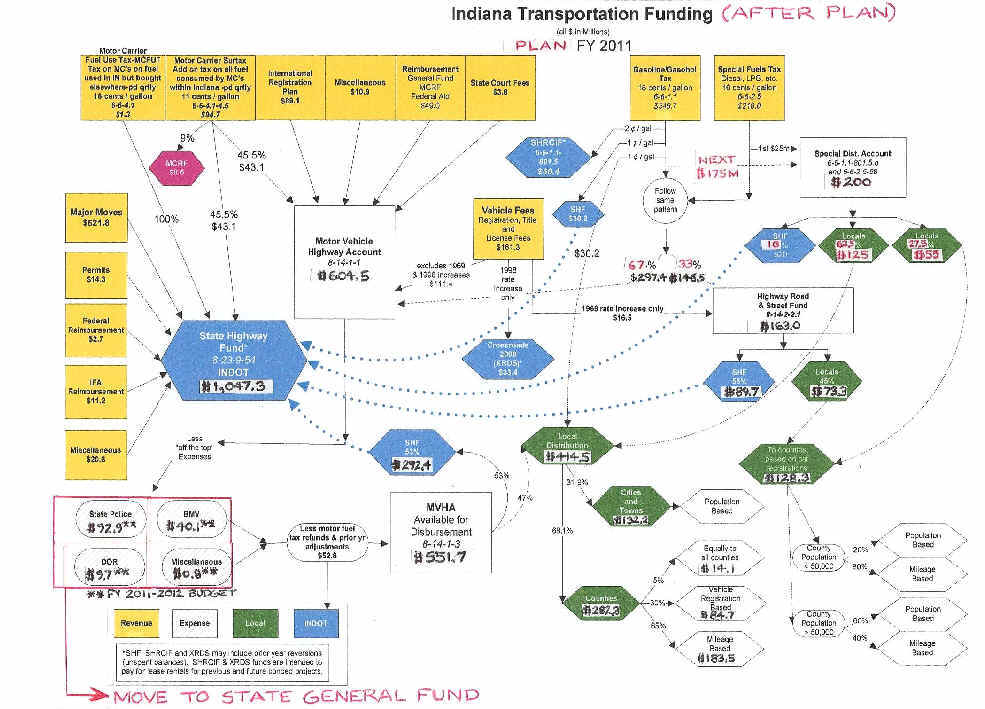

Implementing the two components of the Indiana Gas Tax Reform Plan would make better use of our Indiana Gasoline Tax dollars. An after-the-gas-tax-reform-plan flow chart is included below.

The Legislative Services Agency (LSA) has completed a financial analysis of the Indiana Gas Tax Reform Plan. The LSA is an independent and bipartisan Indiana government agency that serves both the Indiana House of Representatives and the Indiana Senate in performing analysis of proposed legislation. The LSA concludes that if it had been implemented in 2011, the Indiana Gas Tax Reform Plan would have increased transportation funding to counties by 40% from $282.7 million to $395.3 million. Cities and towns transportation funding would have increased 38% from $90.6 million to $125.1 million. The Indiana Gas Tax Reform Plan would have decreased the 2011 State Highway Fund by only 0.3% from $1.0254 billion to $1.0219 billion. NOTE: A PDF copy of the LSA financial analysis of the Indiana Gas Tax Reform Plan is available on request by sending an E-mail to taxless3@comcast.net. (NOTE: some monetary figures from the LSA analysis are a little lower than those included in the after-the-gas-tax-reform-plan flow chart because the $191.4 million non-transportation funding total in the before-the-gas-tax-reform-plan flow chart is incorrect and should be $143.5 million.)

If it had been implemented in 2011, the Indiana Gas Tax Reform Plan would have increased from 71% to 79% the amount of the $546.7 million from our 18-cents-per-gallon Gasoline Tax dedicated directly to the construction and maintenance of our Indiana streets, roads, and highways without borrowing. Our counties would have received 6.7 cents of the Gasoline Tax rate instead of 4.7 cents, and our cities and towns would have received 1.8 cents instead of only 1.4 cents. The State Highway Fund would have continued receiving 5.7 cents, while spending NOT directly related to the construction and maintenance of our Indiana streets, roads, and highways would have decreased from 5.2 cents to 3.8 cents. The Indiana Gas Tax Reform Plan uses 14.2 cents of our Gasoline Tax to directly meet our transportation needs.

The state’s General Fund has ample enough reserves so that non-transportation funding can be properly moved from the state’s Motor Vehicle Highway Account to the General Fund. Implementing the remainder of the Indiana Gas Tax Reform Plan would significantly increase transportation funding to our counties, cities, and towns. There would be no logical need for an Indiana Gasoline Tax increase and for any more counties to impose a Wheel Tax. Indeed, some counties might decide to stop imposing their regressive Wheel Taxes!

If your County Council and other elected public servants express a desire to impose a Wheel Tax, insist that they instead pressure our General Assembly to pass the Indiana Gas Tax Reform Plan. Supporters of the Plan should include the Indiana Association of Counties, the Indiana Association of County Commissioners, and the Indiana Association of Cities and Towns.

State Representative Jeff Thompson has agreed to author a bill for the 2013 General Assembly session that implements the Gas Tax Reform Plan.

Representative Thompson, a Taxpayer Friendly legislator from Lizton in Hendricks County who serves on the House Ways and Means Committee, believes the Gas Tax Reform Plan will receive serious consideration in the 2013 session of our General Assembly.PLEASE contact your State Representative and State Senator and ask them to support the Indiana Gas Tax Reform Plan to Better Use Indiana Gasoline Tax Dollars. Information on how to identify and contact your General Assembly public servants can be found online at http://www.finplaneducation.net/general_assembly_ratings.htm.

PLEASE

access the online form through http://www.in.gov/gov/2631.htm and send Governor Mitch Daniels a comment asking him to please support the Indiana Gas Tax Reform Plan.PLEASE send an E-mail to State Budget Director Adam Horst at ahorst@sba.in.gov asking him to please include the Indiana Gas Tax Reform Plan in the next state budget.

NOTE: A good resource to help understand the Indiana Gasoline Tax is the YouTube video "Understanding the Gas Tax - Indiana" at http://www.youtube.com/watch?v=iccxGbHTftY&feature=youtube_gdata_player.