Lebanon Memorial Park Swimming Pool

![]() Watchdog Indiana Home Page

Watchdog Indiana Home Page

![]() Watchdog Lebanon Home Page

Watchdog Lebanon Home Page

Pool Operating Losses

As detailed in the spreadsheet below, the 2014 operating loss of $25,782 for the new pool in its first year of operation was more than the 2012 and 2013 old pool operating losses of $18,796 and $24,041. The 2015 proposed operating expenses budget for the new pool of $132,750 is significantly more than the 2014 new pool actual operating expenses of $78,569. In order to limit the 2015 operating loss at the 2014 operating loss amount of $25,782, the 2015 pool fees revenue will have to be $54,181 (or 103%) more than the 2014 pool fees revenue of $52,787.

|

Lebanon Memorial Park Swimming Pool Operating Expenses & Revenues |

|||||

|

PARK AND RECREATION 204 |

|||||

|

(Compiled April 21, 2015) |

|||||

|

Sources: |

|||||

|

A. March 23, 2015, E-mail from the Lebanon Clerk-Treasurer |

|||||

|

B. March 25, 2015, E-mail from the LebanonClerk-Treasurer |

|||||

|

C. 2015 Proposed Lebanon City Budget |

|||||

|

D. April 17, 2015, review of Lebanon Utility bills in the Clerk-Treasurer's office |

|||||

|

Operating Expenses |

2012 Actual |

2013 Actual |

2014 Actual |

2015 Proposed |

|

|

119 |

Pool Staff |

$23,664 |

$16,693 |

$48,767 |

$83,000 |

|

215 |

Pool Supplies - Chemicals only |

$10,632 |

$7,289 |

$12,427 |

$18,000 |

|

218 |

Pool Testing Supplies |

$702 |

$350 |

$625 |

$1,200 |

|

230 |

Misc. Pool Equipment |

$0 |

$514 |

$734 |

$2,500 |

|

355 |

Pool-Equip repair supplies & Parts |

$3,340 |

$4,043 |

$4,200 |

$10,000 |

|

362 |

Pool Guard Uniforms |

$352 |

$454 |

$888 |

$3,000 |

|

Electricity - pool pumps |

$4,270 |

$445 |

$7,981 |

$10,850 |

|

|

Water - pool, bath house, park office |

$2,301 |

$2,562 |

$2,461 |

$3,400 |

|

|

Water - wave pool |

$486 |

$800 |

|||

|

TOTAL Operating Expenses |

$45,261 |

$32,350 |

$78,569 |

$132,750 |

|

|

TOTAL Pool Fees Revenue |

$26,465 |

$8,309 |

$52,787 |

||

|

OPERATING LOSS |

$18,796 |

$24,041 |

$25,782 |

||

|

Notes: |

|||||

|

1. 2015 pool pumps electricity estimated at 31% of 2015 proposed budget of $35,000 for Electricity & Gas |

|||||

|

2. 2015 pool, bath house, park office water estimated at 17% of 2015 proposed budget of $20,000 for Water |

|||||

|

3. 2015 wave pool water estimated at 4% of 2015 proposed budget of $20,000 for Water |

|||||

New Pool Price Increases

A committee consisting of Jerry Freeman, Jeremy Lamar, and Neil Taylor prepared a 2014 fees proposal to use the new Lebanon pool. The proposed 2014 pool fees were first presented to the Lebanon Department of Parks Board on March 5, 2014. A “courtesy” presentation of the fees was made to all of the Lebanon City Council members at their March 10, 2014, meeting. The Lebanon Department of Parks Board members Mike Burns, Jerry Freeman, Laurie Gross, and Michelle Thomas (Karen Galvin and Neil Taylor were absent) approved the proposed fees without alteration at their April 2, 2014, meeting. The Lebanon Department of Parks Board members Mike Burns, Jerry Freeman, Laurie Gross, and Jeff Tribbett (Karen Galvin and Michelle Thomas were absent) revised the pool fees at their April 1, 2015, meeting.

The revised 2015 fees to use the new Lebanon pool are listed next. For comparison purposes, the 2013 pool fees for the old pool are also listed.

Age 1 and Under

2013: $1.00

2015: Free

Decrease

Ages 2 to 4

2013: $1.00

2015: $2.00

100% Increase

Ages 5 to 13

2013: $2.00

2015: $4.00

100% Increase

Note: A Twilight Pass Monday through Friday 4:00 PM to 7:00 PM is $3.00.

Ages 14 to 17

2013: $3.00

2015: $4.00

33% Increase

Note: A Twilight Pass Monday through Friday 4:00 PM to 7:00 PM is $3.00.

Ages 18 to 61

2013: $3.00

2015: $5.00

67% Increase

Note: A Twilight Pass Monday through Friday 4:00 PM to 7:00 PM is $3.00.

Ages 62 and Over

2013: Free

2015: $5.00

Increase

Note: A Twilight Pass Monday through Friday 4:00 PM to 7:00 PM is $3.00.

Adults Only Swims Ages 18 to 61

(Monday through Friday 8:15 AM to 9:45 AM with no lifeguards)

2013 (8:15 AM to 10:00 AM): $1.00

2015 (8:15 AM to 9:45 AM): $1.00

Same

Adults Only Swims Ages 62 and Over

(Monday through Friday 8:15 AM to 9:45 AM with no lifeguards)

2013 (8:15 AM to 10:00 AM): Free

2015 (8:15 AM to 9:45 AM): $1.00

Increase

Ten-Visit Punch Card Ages 5 to 13

2013: $15.00

2015: Not Available

Ten-Visit Punch Card Ages 14 to 61

2013: $25.00

2015: Not Available

Babysitter Season Pass

2013: $20.00

2015: Not Available

Individual Season Pass

2013: $40.00

2015: $60.00

50% Increase

Family of 2 Season Pass

2013: $60.00

2015: $90.00

50% Increase

Family of 3 Season Pass

2013: $75.00

2015: $120.00

60% Increase

Family of 4 Season Pass

2013: $105.00

2015: $150

43% Increase

Family of 5 and More Season Pass

2013 (same as for a family of 4): $105.00

2015: $150 plus $20 for each additional family member above 4

62% Increase for a Family of 5

157% Increase for a Family of 10

NOTE: 2015 pool users ages 2 to 4 and ages 18 and up who are not Lebanon residents pay $1.00 more per day than Lebanon residents. Non-residents pay $1.00 more per day for Adults Only Swims. Non-residents also pay $10.00 more for season passes. An “honor” system will be used to identify non-resident users.

Babies under two years old are the only pool users whose fee will be less in 2015 than 2013. Adults Only swimmers ages 18 to 61 will pay the same $1.00 fee. Other 2015 fees will be from 33% to more than 100% higher than in 2013.

It is particularly disturbing that Lebanon residents ages 62 and older no longer have free use of their pool. Jerry Freeman was callous enough to share his opinion at the April 2, 2014, Parks Board meeting that senior citizens have more money than families with which to pay pool fees. It should probably not be too surprising that an appointee of Lebanon Mayor Huck Lewis will have little regard for the effects of tax and fee increases on older Lebanon residents trying to make ends meet on fixed incomes.

Outcome

No legal recourse remains to keep Lebanon Mayor Huck Lewis, The Lebanon City Council (Keith Campbell, John Copeland, Lana Kruse, Mike Kincaid, Jeremy Lamar, Steve Large, Preston Myers), and the Lebanon Department of Parks Board (Mike Burns, Jerry Freeman, Karen Galvin, Laurie Gross, Neil Taylor, Michele Thomas) from imposing property tax increases to pay for two $2 million bond issues to build the $4.52 million new Memorial Park pool (the $520,000 not covered by bonds comes from a Lebanon Redevelopment Commission grant).

Concerned taxpayers who believed the city should use its ample resources to build any new pool without a tax increase intended to initiate the petition and remonstrance process to defeat the pool project. Even though it is prohibited by Indiana Code 6-1.1-20-3.1(c), Lebanon avoided the petition and remonstrance process by artificially dividing the $4.52 million new pool project into three capital projects each of which do not exceed the $2 million petition and remonstrance trigger.

The mayor and every city council and parks board member knew beforehand from multiple E-mails, letters to the editor, and public hearing testimony that artificially dividing the new pool project into multiple capital projects was an unlawful avoidance of the petition and remonstrance process (see the "Timeline" below). However, they all acted unanimously to proceed with the second $2 million bond issue after the first $2 million bond issue was sold on July 30, 2013.

Concerned taxpayers struggled to determine what legal recourse was available to defeat the unlawful second $2 million bond issue. It was discovered from the Indiana Transparency Portal on February 10, 2014, that the second $2 million bond issue was sold on December 5, 2013. The 2014 interest payments for this second bond issue were capitalized and a property tax increase will be imposed for the next 13 years starting in 2015 (a property tax increase begins this year for the next 14 years to pay for the first $2 million bond issue).

The concerned taxpayers first made contact on November 9, 2013, with our Indiana Department of Local Government Finance in hopes the DLGF is required by our Indiana Code to enforce the legal prohibition against artificial division of capital projects. The DLGF is not allowed to provide direct legal advice to taxpayers, and it did not become clear until February 18, 2014, that the concerned taxpayers had missed the deadline for the only available legal recourse against the purposeful unlawful actions of our elected and appointed public servants.

Indiana Code provisions 6-1.1-18.5-8(g) and (h) stipulate that DLGF review and approval is not required for local bond issues and capital projects. The only available legal recourse is identified in IC 36-10-4-35(i), “An action to question the validity of bonds of the district or to prevent their issue may not be brought after the date set for the sale of the bonds.” What this means is that concerned taxpayers could have gone to court before December 5, 2013, to seek an injunction to keep the second $2 million bond issue from being issued.

There were probably a lot of “gotcha” snickers in the municipal building as December 5, 2013, approached with the concerned taxpayers floundering around and not filing a court case. The fact that municipal officials would force their concerned taxpayers to take court action to uphold the law is gotcha politics at its worst. To counter the continuation of gotcha politics, concerned taxpayers need to convince our elected officials they may face gotcha retribution during the 2015 municipal elections.

Pool Costs Summary

Two $2 million Pool Bonds have been issued to build Lebanon’s $4.52 million new Memorial Park swimming pool (the $520,000 not covered by bonds comes from a Lebanon Redevelopment Commission grant). As detailed elsewhere on this web page, the $4.52 million new pool project was artificially divided into three capital projects to unlawfully avoid the petition and remonstrance process.

The Pay 2014 property tax increase to pay the debt service on the $2 million Pool Bond that closed on August 8, 2013, is $0.0354 per $100 of assessed value. The 2014 interest on the $2 million Pool Bond that closed on December 19, 2013, was capitalized – meaning that a second property increase of about $0.0354 per $100 of assessed value will be imposed next year. The final debt service payments on both of the $2 million Pool Bonds will not be made until January 1, 2028.

A committee consisting of Jerry Freeman, Jeremy Lamar, and Neil Taylor prepared a 2014 fees proposal to use the new Lebanon pool. The proposed 2014 pool fees were first presented to the Lebanon Department of Parks Board on March 5. A “courtesy” presentation of the fees was made to all of the Lebanon City Council members at their March 10 meeting. The Lebanon Department of Parks Board members Mike Burns, Jerry Freeman, Laurie Gross, and Michelle Thomas (Karen Galvin and Neil Taylor were absent) approved the proposed fees without alteration at their April 2 meeting. The approved 2014 fees to use the new Lebanon pool are listed next; also listed are the 2013 pool fees for comparison purposes.

Age 1 and Under

2013: $1.00

2014: Free

Decrease

Ages 2 to 4

2013: $1.00

2014: $2.00

100% Increase

Ages 5 to 13

2013: $2.00

2014: $4.00

100% Increase

Ages 14 to 17

2013: $3.00

2014: $4.00

33% Increase

Ages 18 to 61

2013: $3.00

2014: $5.00

67% Increase

Ages 62 and Over

2013: Free

2014: $5.00

Increase

Adults Only Swims Ages 18 to 61

(Monday through Friday with no lifeguards)

2013 (8:15 AM to 10:00 AM): $1.00

2014 (8:15 AM to 9:45 AM): $1.00

Same

Adults Only Swims Ages 62 and Over

(Monday through Friday with no lifeguards)

2013 (8:15 AM to 10:00 AM): Free

2014 (8:15 AM to 9:45 AM): $1.00

Increase

Ten-Visit Punch Card Ages 5 to 13

2013: $15.00

2014: Not Available

Ten-Visit Punch Card Ages 14 to 61

2013: $25.00

2014: Not Available

Babysitter Season Pass

2013: $20.00

2014: Not Available

Individual Season Pass

2013: $40.00

2014: $60.00

50% Increase

Family of 2 Season Pass

2013: $60.00

2014: $90.00

50% Increase

Family of 3 Season Pass

2013: $75.00

2014: $120.00

60% Increase

Family of 4 Season Pass

2013: $105.00

2014: $150

43% Increase

Family of 5 and More Season Pass

2013 (same as for a family of 4): $105.00

2014: $150 plus $20 for each additional family member above 4

62% Increase for a Family of 5

157% Increase for a Family of 10

NOTE: 2014 pool users ages 2 and up who are not Lebanon residents pay $1.00 more per day than Lebanon residents. Non-residents pay $10.00 more for season passes. An “honor” system will be used to identify non-resident users.

Babies under two years old are the only pool users whose fee will be less in 2014 than 2013. Adults Only swimmers ages 18 to 61 will pay the same $1.00 fee. Other 2014 fees will be from 33% to more than 100% higher than in 2013.

It is particularly disturbing that Lebanon residents ages 62 and older no longer have free use of their pool. Jerry Freeman was callous enough to share his opinion at the April 2 Parks Board meeting that senior citizens have more money than families with which to pay pool fees. It should probably not be too surprising that an appointee of Lebanon Mayor Huck Lewis will have little regard for the effects of tax and fee increases on older Lebanon residents trying to make ends meet on fixed incomes.

Petition and Remonstrance Process

Watchdog Indiana would have gotten the 100 petition signatures necessary to initiate the petition and remonstrance process if our Lebanon City Council had approved a swimming pool bond issue that exceeded $2 million and was paid for by a property tax increase. Information regarding the Petition and Remonstrance Process can be found online at http://www.finplaneducation.net/petition_remonstrance.htm.

Timeline

The timeline listed next details how Lebanon has disregarded Indiana Code IC 6-1.1-20-3.1(c) and artificially divided its $4.52 million new pool project into multiple capital projects to unlawfully avoid the petition and remonstrance process. The page numbers referenced in this timeline refer to 37 pages of supporting documentation that was mailed to the Indiana Department of Local Government Finance on November 27, 2013.

(1) The October 5, 2011, Financial Management Plan prepared by H.J. Umbaugh for the City of Lebanon includes a $4.56 million lease rental bond issue for a new City of Lebanon swimming pool within Lebanon’s Memorial Park. The attached page A-1 is a public records request submitted to the Lebanon Clerk-Treasurer on November 22, 2013, to inspect the Financial Management Plan. Copies of the Financial Management Plan pages pertaining to the $4,560,000 pool bond issue will be forwarded to you after the Lebanon Clerk-Treasurer makes the Financial Management Plan available for my inspection and copying. (Note: The $4,560,000 pool bond issue was found to be included in the Financial Management Plan when I first inspected the Plan in the Lebanon Clerk-Treasurer’s office on January 29, 2013.)

(2) The attached pages B-1 and B-2 are a September 26, 2012, article from The Lebanon Reporter about the Lebanon Parks Department proposal presented to the Lebanon City Council on September 24, 2012 for a new Lebanon swimming pool. Please note that the new pool “would feature a wave pool with a beach entry, and include a lazy river, play areas, a spray toy, water slides and a splash pad” at a cost “around $4 million.”

(3) The attached pages C-1 and C-2 show how I contacted the Boone County Clerk, Penny Bogan, as early as September 26, 2012, regarding how to work with her office to properly administer the petition and remonstrance process for a new Lebanon swimming pool bond issue.

(4) The attached page D-1 is a November 1, 2012, letter to The Lebanon Reporter Editor announcing, “If the Lebanon City Council decides to approve a $4 million bond issue for the proposed new aquatic center instead of finding a way to build it without a tax increase, Watchdog Indiana will go door-to-door to use the Petition and Remonstrance Process to try and defeat the aquatic center bond issue.”

(5) The attached pages E-1, E-2, and E-3 show how I contacted the Boone County Clerk (Penny Bogan) and the Boone County Attorney (Bob Clutter) on December 14, 2012, with information on how to properly administer the petition and remonstrance process for a new Lebanon swimming pool bond issue.

(6) The attached page F-1 is a December 14, 2012, E-mail read receipt from the Boone County Attorney, Bob Clutter, showing that he received my December 14, 2012, E-mail with information on how to properly administer the petition and remonstrance process for a new Lebanon swimming pool bond issue. It is important to note that Bob Clutter was on December 12, and is still today, both the Boone County Attorney and the Lebanon City Attorney.

(7) The attached pages G-1, G-2, and G-3 are the Minutes for the January 28, 2013, meeting of the Lebanon City Council. Please note that the Council passed a motion “to move forward” with design work on a new Lebanon swimming pool.

(8) The attached pages H-1, H-2, and H-3 are the Minutes for the February 6, 2013, meeting of the Lebanon Department of Parks Board. Please note that the Board passed a motion to approve a design contract for a new Lebanon swimming pool.

(9) The attached page I-1 is a February 14, 2013, letter to The Lebanon Reporter Editor. Please note that the two sentences from this letter listed next reference how the petition and remonstrance process will be initiated for a new Lebanon swimming pool bond issue. “The city must be pretty confident that Lebanon citizens will not successfully use the petition and remonstrance process to defeat the bond issue.” “Watchdog Indiana will get the 100 petition signatures necessary to initiate the petition and remonstrance process if our Lebanon City Council approves a $4 million swimming pool bond issue paid for with a property tax increase.”

(10) The attached pages J-1, J-2, and J-3 are the May 1, 2013, declaratory and preliminary determination resolution of the Lebanon Department of Parks Board to issue $2 million in bonds to “complete park improvements, including existing pool demolition, construction and installation of pool vessel, pool deck, fence and utilities and new mechanical building, together with necessary appurtenances, related improvements and equipment, and the incidental expenses in connection therewith and the issuance of bonds.”

(11) The attached pages K-1, K-2, and K-3 are the Minutes for the June 10, 2013, meeting of the Lebanon City Council. Please note that the Council passed resolution 2013-11 approving a $2 million bond issue for a new Lebanon swimming pool.

(12) The attached pages L-1, L-2, and L-3 are an Indiana Gateway Report showing that a $2 million City of Lebanon bond issue was closed on August 8, 2013, for “Existing pool demolition, construction and installation of pool vessel, deck, fence and utilities.”

(13) The attached pages M-1 and M-2 are the Minutes for the September 9, 2013, meeting of the Lebanon Redevelopment Commission. Please note that the Commission passed resolution 2013-06 allocating up to $520,000 of Tax Increment Financing funds on amenities for the new Lebanon swimming pool. This Commission allocation increased the total cost of the new Lebanon swimming pool from $2 million to $2.52 million.

(14) The attached page N-1 is an October 26, 2013, letter to The Lebanon Reporter Editor detailing how the $2.52 million new Lebanon swimming pool project was artificially divided into multiple capital projects to avoid the petition and remonstrance process.

(15) The attached page O-1 is a November 12, 2013, public notice in The Lebanon Reporter from the Lebanon Department of Parks Board of the determination to issue $2 million in bonds to “complete park improvements, including construction of a wave pool, mechanical building, concessions/admission building and associated decking at the Lebanon Memorial Park Pool, together with necessary appurtenances, related improvements and equipment and the incidental expenses in connection therewith and the issuance of bonds.” This bond issue would increase the total cost of the new Lebanon swimming pool from $2.52 million to $4.52 million, which is almost identical to the $4.56 million pool lease rental bond issue referenced in the October 5, 2011, Financial Management Plan prepared by H.J. Umbaugh for the City of Lebanon – see the preceding item (1) of this timeline.

(16) The attached page P-1 is a November 12, 2013, public notice in The Lebanon Reporter from the Lebanon Department of Parks Board of the adoption and content of and public hearing on a Declaratory Resolution “preliminarily finding that it will be of public utility and benefit to the citizens and the taxpayers of the District to complete park improvements, including construction of a wave pool, mechanical building, concessions/admission building and associated decking at the Lebanon Memorial Park Pool, together with necessary appurtenances, related improvements and equipment and the incidental expenses in connection therewith and the issuance of bonds.”

(17) The attached page Q-1 is a November 12, 2013, public notice in The Lebanon Reporter from the Lebanon Department of Parks Board of a December 4, 2013, public hearing on an additional appropriation of $2 million from a bond issue to “complete park improvements, including construction of a wave pool, mechanical building, concessions/admission building and associated decking at the Lebanon Memorial Park Pool, together with necessary appurtenances, related improvements and equipment and the incidental expenses in connection therewith and the issuance of bonds.”

(18) The attached pages R-1 and R-2 are Resolution 2013-18 passed by the Lebanon City Council on November 12, 2013, approving the issuance of bonds by the Lebanon Department of Parks board not to exceed $2 million to “complete park improvements, including existing pool demolition, construction and installation of pool vessel, pool deck, fence and utilities and new mechanical building, together with necessary appurtenances, related improvements and equipment, and the incidental expenses in connection therewith and the issuance of bonds.”

(19) The attached page S-1 is a November 14, 2013, article from The Lebanon Reporter that presents some information on how the second $2 million bond issue would enable the new Lebanon swimming pool to be completed for a total cost of $4.52 million that is just a little less than the amount first referenced in the October 5, 2011, Financial Management Plan prepared by H.J. Umbaugh for the City of Lebanon – see the preceding item (1) of this timeline.

(20) The attached page T-1 is a November 16, 2013, letter to The Lebanon Reporter Editor that summarizes how the $4.52 million new Lebanon swimming pool project has been artificially divided into multiple capital projects to avoid the petition and remonstrance process.

The preponderance of evidence clearly shows that the $4.52 million new Lebanon swimming pool project has been artificially divided into multiple capital projects to avoid the petition and remonstrance process. Therefore, the $2 million bond issue intended to provide the additional appropriation funding that the Lebanon Department of Parks Board is expected to certify to the Indiana Department of Local Government Finance for approval on or after December 4, 2013, cannot be lawfully issued. For this reason, the DLGF is requested to disapprove the anticipated Lebanon Department of Parks Board additional appropriation.

Initial $4 million Pool Proposal

On September 24, 2012, Cory Whitesell of Hannum, Wagle and Cline Engineering

and Park Director John Messenger presented to the Lebanon City Council a Lebanon

Parks recommendation that a $4 million bond issue be approved to replace the

existing 50-meter outdoor lap pool and diving well in Lebanon Memorial Park with

a new “aquatic center” that would open in 2014. Some of the presentation information is summarized

next.

(1) The $4 million bond issue would cover the construction work “hard costs”

and the “soft cost” expenses such as engineering services, publication of

notices, and bonds preparation and selling.

(2) The aquatic center would feature a “wave pool” with a “beach entry”

and include a “lazy river,” play areas, a spray toy, water slides, new pool

deck, new deck furnishings, new shade structures, high-efficiency mechanical

systems, and a

“splash pad.” The lazy river in the aquatic center would include a current

that provides resistance for senior citizens to use while they exercise. Swim

lessons and water aerobics would continue. The wave generation equipment would

cost $100,000, a new wave pool mechanical building would cost $72,000, and the

splash pad would cost $150,000. The proposed new aquatic center is

depicted by the Alternative 2 pool concept at http://www.cityoflebanon.org/parks/documents/poolconcepts_000.pdf.

(3) The aquatic center would not include a lap pool because Lebanon already has

two lap pools available to the public – one at Lebanon High School and the

second at Witham Family YMCA. The swim club only uses the park pool for a week

each year when the LHS pool is closed, and few adults use the park pool for lap

swimming.

(4) The aquatic center might attract Lebanon visitors because the nearest wave

pool is now 75 miles away. However, most wave pools in Indiana locales the size

of Lebanon “barely break even” when it comes to meeting operating expenses.

(5) The existing park pool (which has a surface area of about 9,400 square feet)

was built in 1979, and the pool liner is 15 years old. The existing pool is a

50-meter, 6-lane "competition" pool that is 3.5 to 5.0 feet deep with

(a) a 35 foot by 40 foot diving well that is up to 12.5 feet deep (with a

one-meter diving board) and (b) a children's wading pool that is one foot deep. It would cost

$1.106 million to extend the life of the existing pool ten years by providing a

new surge tank and replacing

the liner, gutter system, concrete deck, main drain lines, supply lines, return

lines, pump flow control valve, guard rails, and perimeter fencing. Pipe leaks

would be repaired and corrosion

needs would be addressed. The existing pool uses 150,000 gallons of water a month

because of the leaks.

(6) It would take less water to fill the new aquatic center than the existing

park pool because the aquatic center would not be as deep. However, NO data has

been provided comparing the operating costs of the existing pool with the

operating costs of a new aquatic center.

(7) A new concession building would be provided within the fence around the

aquatic center.

(8) The existing bath house and Parks Department office would only require a few

minor modifications to remain part of the aquatic center "for many years to

come." Also, the current filter could be used in the new aquatic center

because it was installed in 2002 and has a 15-year warranty.

(9) No additional parking lot areas would be required.

(10) A "splash pad" costing $150,000 would be built near the existing playground at Abner Longley Park. This unsupervised splash pad, which would be free to the public, would cost $4,000 to $6,000 per year to operate.

(11) A total of 604 persons responded to a pool survey. Only 31.5% of the persons responding use the existing pool monthly, weekly, or daily, and 28.8% never use the existing pool.

Artificially Divided Capital Project #1

To build the new pool, the Lebanon Board of Park Commissioners on June 5, 2013, approved a 14-year $2 million bond issue that will require $185,000 in annual debt service payments. A property tax rate increase of $0.0250 will be needed to make the annual $185,000 debt service payments on the 14-year $2 million bond issue. As noted below under "Funding Options," the City of Lebanon had ample funds available to build a new pool without a tax increase.

The $360.06 in property taxes that the homeowners at 2625 Countryside Drive will pay to the City of Lebanon this year is 38.25% more than the $260.44 paid in 2009. The 2013 property tax increase of 38.25% is more than four times greater than the 9.05% inflation increase from April 2009 to April 2013. If the assessed value stays the same, the homeowners at 2625 Countryside Drive will pay $10.58 more property tax in 2014 for the new pool ($42,305 net assessed value multiplied by the $0.0250 property tax rate increase and divided by $100). If our Lebanon City Council limits its 2014 property tax increase to just the new pool, the 2625 property taxes paid to the City of Lebanon will increase 2.94% from $360.06 to $370.64.

The final decision to approve a tax increase to pay for the $2 million new pool bond issue was made by our Lebanon City Council Members Keith Campbell, John Copeland, Mike Kincaid, Lana Kruse, Jeremy Lamar, Steve Large, and Preston Myers with a unanimous vote at the June 10, 2013, Lebanon City Council meeting.

Artificially Divided Capital Project #2

The referendum process and the petition and remonstrance process protect taxpayers from unneeded or unwanted property tax increases caused by debt payments for local government capital projects.

Any type of school building project is subject to referendum if the cost exceeds $10 million. Other local government capital projects are subject to referendum if the cost exceeds the lesser of $12 million or 1% of the local government’s assessed value (if that amount is at least $1 million).

If the cost of a local government capital project does not trigger a referendum, the project is subject to the petition and remonstrance process if the project will cost more than the lesser of $2 million or 1% of the local government’s assessed value (if that amount is at least $1 million).

House Enrolled Act 1116 was passed by the General Assembly earlier this year. One provision in HEA 1116 added the new section 6-1.1-20-0.5 to the Indiana Code which provides that the cost of a local capital project does not include expenditures that will be paid from donations or other gifts. The terms “donations” and “gifts” are not defined.

IC 6-1.1-20-0.5 provides a loophole for local governments to improperly circumvent the taxpayer protections provided by the referendum process and the petition and remonstrance process against unwanted or unnecessarily costly capital projects.

An example of how IC 6-1.1-20-0.5 is poor public policy is demonstrated by the new City of Lebanon swimming pool that is now under construction.Lebanon originally proposed a $4 million pool whose bond repayments would be made through a property tax increase. Lebanon avoided a Watchdog Indiana promise to initiate the petition and remonstrance process by lowering the pool cost and issuing bonds totaling $2 million. The Lebanon Redevelopment Commission then voted 4-0 on September 9, 2013, to spend up to $520,000 of RDC cash reserves on amenities for the new pool. Lebanon’s new $2.52 million pool is now under construction and scheduled to open next year.

The bottom line is that Lebanon’s taxpayers wanted their city government to properly use its ample available resources and build the pool without a tax increase. Because of the IC 6-1.1-20-0.5 loophole, Lebanon was able to increase its property taxes to pay $2 million of the new pool cost while using the RDC donation (or gift) to cover the remaining $520,000. If the IC 6-1.1-20-0.5 loophole did not exist, Lebanon’s taxpayers would have used the $2.52 million pool cost to trigger the petition and remonstrance process and avoid any property tax increase whatsoever to pay for the new pool.

Our General Assembly needs to eliminate the IC 6-1.1-20-0.5 loophole so local governments cannot improperly bypass the taxpayer protections provided by the referendum process and the petition and remonstrance process against unwanted property tax increases to pay for costly capital projects.

Artificially Divided Capital Project #3

On November 6, 2013, the Lebanon Department of Parks Board – Mike Burns, Jerry Freeman, Karen Galvin, Laurie Gross, Neil Taylor, Michele Thomas – unanimously approved another $2 million bond issue to build a wave pool, concession stand, and decking within Lebanon’s Memorial Park. This is in addition to the $2 million pool bond issue approved by the Lebanon City Council on June 10, 2013, and the $520,000 approved by the Lebanon Redevelopment Commission on September 9, 2013, for other pool amenities at the same site. If Lebanon were not artificially dividing the $4.52 million new pool project into multiple capital projects that do not exceed $2 million each, Lebanon’s taxpayers would have used the petition and remonstrance process to avoid property tax increases to pay for the new pool. As detailed under the "Funding Options" heading below, Lebanon has ample resources to build the new pool without property tax increases.

The Lebanon City Council already approved a property tax increase for the first $2 million bond issue it passed on June 10, 2013. In spite of the ample resources available to build the new pool without property tax increases, Council also approved a tax increase to pay for the second $2 million pool bond issue at its November 12, 2013, meeting.

Lebanon City Council members were not good enough public servants to hold a public hearing themselves regarding the latest $2 million pool bond issue. A sham public hearing was scheduled before the Lebanon Department of Parks Board on December 4, 2013, where the Parks Board members were unsuccessfully urged to act honorably and disapprove the additional appropriation spending the proceeds from the second $2 million bond issue because the new pool project was unlawfully divided into multiple capital projects to avoid the petition and remonstrance process.

Artificially dividing the $4.52 million new pool project into multiple capital projects that do not exceed $2 million each is clearly illegal according to Indiana Code IC 6-1.1-20-3.1(c). However, this has not dissuaded Lebanon Mayor Huck Lewis (and his compliant legal counsel) from pursuing this latest tax-increasing scheme while hoarding the ample funds already provided by taxpayers for low-priority projects of dubious merit (like the Indianapolis Avenue “gateway” roundabouts).

Funding Options

Current plans call for the principal and interest on the $2 million 14-year bond issue for the new aquatic center to be “payable out of a special tax levied on all of the property” within the City of Lebanon (and outside the Lebanon Business Park TIF district). In other words, there would be a Lebanon property tax increase to pay the principal of the bonds as they mature together with all accruing interest.

On June 5, 2013, an H. J. Umbaugh representative reported to the Lebanon Board of Park Commissioners that the $2 million needed for the new aquatic center will be provided by a 14-year bond issue that will require $185,000 in annual debt service payments. The bonds will have no capitalized interest and will be callable after 8 years. A property tax rate increase of $0.0250 will be needed to make the annual $185,000 debt service payments on the 14-year $2 million bond issue.

As detailed next, the property taxes paid to the City of Lebanon from the homestead at 2625 Countryside Drive increased all four years since 2009:

2009: $260.44 Gross Property Tax (before state property tax relief)

2010: $277.23 Gross Property Tax (before state homestead credit)

(6.45% increase from 2009)

2011: $290.01 Total Property Tax Liability Due

(4.61% increase from 2010 and 11.35%

increase from 2009)

2012: $334.83 Total Property Tax Liability Due

(15.45% increase from 2011 and 28.56%

increase from 2009)

2013: $360.06 Total Property Tax Liability Due

(7.54% increase from 2012 and 38.25%

increase from 2009)

The 2625 Countryside Drive Pay 2013 City property tax burden of $360.06 is 38.25% more than the Pay 2009 obligation of $260.44. The Pay 2013 City property tax increase of 38.25% is more than four times greater than the 9.05% inflation increase from April 2009 to April 2013. For comparison purposes over the same four year time period, the property taxes paid (1) to Boone County decreased 7.17%, (2) to Center Township decreased 7.21%, (3) to Lebanon Community School Corporation decreased 30.79%, and (4) to the Lebanon Public Library decreased 24.09%. The bottom line is that the county, township, schools, and library have been a lot more fiscally responsible than the City during this time of slow recovery from the Great Recession.

If the assessed value stays the same, the home at 2625 Countryside Drive will pay $10.58 more property tax in 2014 for the new aquatic center ($42,305 net assessed value multiplied by the $0.0250 property tax rate increase and divided by $100). If our Lebanon City Council limits its 2014 property tax increase to just the new aquatic center, the 2625 Countryside Drive property taxes paid to the City of Lebanon will increase 2.94% from $360.06 to $370.64.

Many everyday Lebanon citizens, particularly the working parents of the 42.2% of Lebanon school students who receive free lunches (up from the 39% who qualified for free lunches in 2009), are fed up that the portion of their 2013 property tax bills going the City of Lebanon has increased 38.25% since 2009 when inflation increased only 9.05%. This is also true for our retired neighbors who pinch pennies to make ends meet on their limited Social Security income. These Lebanon residents do not want to pay for a new pool they can’t afford to enjoy if the admission fees for the new pool increase as expected.

Because Lebanon homes assessed at $243,000 are now at the maximum property tax that can be imposed under the property tax caps, Lebanon businesses, farmers, renters, and owners of homes valued below $243,000 would pay the property tax increase for a new $2 million aquatic center. It is galling that well-to-do Lebanon residents living in homes valued more than $243,000 would get a new aquatic center for free!

The state law that governs the newly established Lebanon Department of Parks Board provides that the bond issue to fund the proposed new aquatic center will not be “corporate obligations or indebtedness” of the city. What this means is that the $2 million bond issue will not count against Lebanon’s $13,791,731 debt limit (2 percent of the Pay 2013 net assessed value of $689,586,599).

Listed next are the portions of the City of Lebanon property taxes from the homestead at 2625 Countryside Drive that went to Lebanon's Parks and Recreation since 2009.

Pay 2009:

$ 47,840 Net Assessed Value (after deductions)

X $0.0312 Park & Recreation Tax Rate (per $100 of Net Assessed Value)

$ 14.93 Park & Recreation Gross Tax Liability

(before state property tax relief)

Pay 2010:

$ 47,840 Net Assessed Value (after deductions)

X $0.0474 Park & Recreation Tax Rate (per $100 of Net Assessed Value)

$ 22.68 Park & Recreation Gross Tax Liability

(before state homestead credit)

Pay 2011:

$ 43,085 Net Assessed Value (after deductions)

X $0.0287 Park & Recreation Tax Rate (per $100 of Net Assessed Value)

$ 12.37 Park & Recreation Property Tax

Liability

Pay 2012:

$ 44,255 Net Assessed Value (after deductions)

X $0.0581 Park & Recreation Tax Rate (per $100 of Net Assessed Value)

$ 25.71 Park & Recreation Property Tax

Liability

Pay 2013:

$ 42,305 Net Assessed Value (after deductions)

X $0.0713 Park & Recreation Tax Rate (per $100 of Net Assessed Value)

$ 30.16 Park & Recreation Property Tax

Liability

(102.01% increase from 2009)

Most Lebanon residents cannot afford another Parks and Recreation property tax increase of $10.58 in 2014 for a new aquatic center.

Lebanon should follow the lead of Greenwood in Johnson County. After having a costly proposed pool project defeated in 2009 through the petition and remonstrance process, Greenwood has decided to build a new aquatic center without raising taxes by using money from two tax increment financing districts. Because of Indiana Code restrictions related to bond issues that do not exceed $2 million, concerned Lebanon voters and property owners cannot use the petition and remonstrance process to defeat a property tax increase to pay for the proposed new Lebanon Memorial Park swimming pool.

Lebanon is “rolling in the deep” when it comes to all the options available to pay the $185,000 that would be needed to make the annual principal and interest payments on a $2 million 14-year bond issue to build the new Memorial Park aquatic center without a tax increase.

As detailed on the Watchdog Lebanon web page at http://www.finplaneducation.net/lebanon_redevelopment_commission.htm, our Lebanon Redevelopment Commission will have annual 2013 through 2021 net cash flows that range from $716,305 to $816,945. Ample RDC funds will be available to make the $185,000 annual debt service payments on the proposed aquatic center. Spending RDC tax dollars on a new pool as an economic development initiative makes more sense than the recent RDC spending of $2 million for SR 39 bridge “decorative panels,” $726,965 to purchase and demolish the Quality Inn, and $500,000 for a Lebanon High School “conference center.”

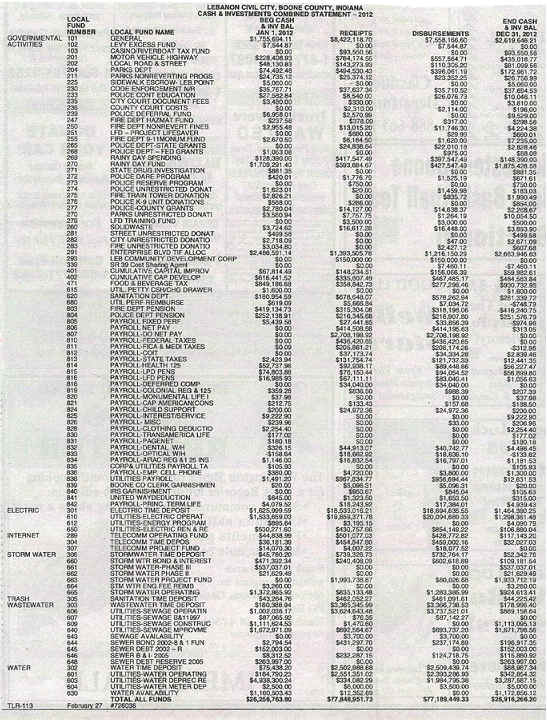

Lebanon’s 2012 Cash & Investments Combined Statement is posted below.

Eight Lebanon governmental activities funds can be used to help pay for a new aquatic center bond issue. The 2012 receipts in these eight Lebanon funds exceeded 2012 disbursements by a whopping $1,106,742.54. The eight funds are listed next together with their balances on December 31,2012.

$2,619,646.21 General Fund

$ 172,961.72 Parks Department

$ 26,756.99 Parks Nonreverting Programs

$ 148,390.00 Rainy Day Spending

$1,875,428.58 Rainy Day Fund

$ 10,054.50 Parks Unrestricted Donation

$ 484,563.84 Cumulative Capital Development

$ 930,732.95 Food & Beverage Tax

$6,268,534.79 TOTAL

Lebanon could pay cash for a new $2 million aquatic center and – if our City Council maintained spending at current levels – replenish the cash balances in less than two years!

If Lebanon is somehow “reluctant” to pay cash for a new aquatic center, there are numerous options available to make the $185,000 annual debt payments on a $2 million 14-year bond issue to build the proposed new aquatic center. The most obvious option is to dedicate the excess annual revenue in the General Fund – Lebanon’s 2012 General Fund receipts were $863,952.10 more than disbursements – to make the debt payments. Also, Lebanon’s $358,000 in annual Food and Beverage Tax revenue could easily be used to make the aquatic center bond payments.

It is nothing short of an outrage that our Lebanon City Council “public servants” would even consider a tax increase to pay for a new Memorial Park aquatic center when they have so much money already available.

Will a new Lebanon aquatic center attract visitors?One of the assertions made during a September 24, 2012, presentation deserves careful scrutiny. Because the nearest wave pool is supposedly 75 miles away in the Grant County city of Marion, enough visitors might be attracted to Lebanon to cover the operating expenses of the new aquatic center without taxpayer subsidy. Park Director Messenger reported that the comparable Marion Splash House takes in more than it spends.

First of all, the STATS Indiana website shows that the 29,838 Marion population is 86 percent more than the 16,022 Lebanon population. Grant County has 69,793 residents while Boone County has only 57,481. Lebanon would have to have a considerably higher per capita use of its new aquatic center to reach the usage level of the Marion Splash House.

Secondly, Marion Splash House daily admission prices are more than two-thirds greater than the current Lebanon Municipal park pool prices. The cost of Marion Splash House season passes are more than one-fourth greater than the current Lebanon pool passes.

The costs to enjoy the Marion Splash House are $5.00 for regular admission, $4.00 for students, $3.00 for seniors 55 and over, free for children 2 and under, and $3.00 per person for groups of 15 or more. Marion Splash House season passes are $50.00 for an individual and $150.00 for a family (up to 4) with $25.00 for each additional family member.

Lebanon Memorial Park Pool prices are now $1.00 for ages 4 and under, $2.00 for ages 5 to 13, $3.00 for ages 14 to 61, and free for ages 62 and over. The adults only swims Monday through Friday from 8:15 AM. to 10:00 AM cost $1.00 per visit. A ten-visit punch card is $15.00 for ages 5 to 13 and $25.00 for ages 14 to 61. Season passes are $40.00 for an individual, $60.00 for a family of 2, $75.00 for a family of 3, and $105.00 for a family of 4 or more. A season pass for a babysitter is $20.00, and a replacement card for a season pass costs $25.00.

The percent of Lebanon students receiving free lunches and textbooks for the 2010-11 school year was 45%. During this time of slow recovery from the Great Recession, Lebanon working families can afford neither tax increases nor pool admission price increases to cover the operating costs of the proposed new aquatic center.

Thirdly, the proposed new aquatic center would not be the only water park attraction within 75 miles of Lebanon. Among others, Zionsville residents would have to visit the new Lebanon aquatic center in great numbers for the aquatic center to be a break-even proposition. The Carmel Waterpark and its FlowRider attraction (be sure to click on the listed YouTube video) is nearer to Zionsville residents than Lebanon Memorial Park. Zionsville residents will not choose a new Lebanon aquatic center over the Carmel Waterpark.

Lafayette has three aquatic attractions - Castaway Bay, Tropicanoe Cove, and Vinton Pool: see http://www.lafayette.in.gov/aquatics/. Castaway Bay has a beach-like entry, water basketball, and a bubble bench. Tropicanoe Cove has a Banana Peel tube slide. The Vinton Pool has a beach-like entrance, double water slide, playful water geysers, large umbrellas, and lap lanes.

Furthermore, Plainfield has an indoor Splash Island as well as an outdoor Splash Island: see http://townofplainfield.com/main/index.php?dept=12&action=1. The Splash Island Indoor Aquatic Center is open year-round and its 20,000 sq. ft. aquatic center features a 5,742 sq. ft. leisure pool that includes three lap lanes, a two-story waterslide, zero-depth entry, an interactive children's play area, gentle winding river, pulsating vortex, and birthday party areas.

Existing Pool Leak Facts

One supposed motivation for a new pool is that the current pool is leaking 150,000 gallons each of the five months that the pool is filled. This is really no problem when one looks closely at the magnitude of the leak and its costs compared to the cost of a new pool paid for by tax increases.

A pool leak of 150,000 gallons a month is not a large leak because it equates to just 27.85 cubic feet an hour for a thirty day month (150,000 gallons per month divided by 720 hours per month divided by 7.48 gallons per cubic foot). Our Memorial Park pool leaks about one cubic yard per hour - a quite small amount compared to how much the ground absorbs in numerous unlined retention ponds throughout our city.

Lebanon Utilities measures the volume of water used to compute its water and sewer bill for the Lebanon Parks Department. For June 12 to July 12, 2012, the Parks Department used 48,129 cubic feet (or 360,005 gallons) of water that resulted in a utility bill of $517.33 for water and $279.74 for sewer. The Parks Department paid $797.07 in water and sewer charges for the use 360,005 gallons of water. Therefore, the 150,000 gallons of pool water leakage accounted for 42% of the Parks Department water usage and cost the Parks Department $332.11. Five months of pool leakage would cost about $1,660.

Living with a leaking pool that costs $1,660 a year is a small price to pay until our Lebanon public servants figure out how to use their ample resources, including the excess revenues of the Lebanon Redevelopment Commission, to pay for a new pool without a property tax increase.

Lebanon Board of Park Commissioners Resolutions for a new Lebanon Memorial Park Aquatic Center

The Declaratory Resolution No. 2013-01 included below was passed on May1, 2013, by the Lebanon Board of Park Commissioners (Michele Thomas was absent) with Mike Burns, Jerry Freeman, Karen Galvin, and Laurie Gross voting Yes and Derek Warren voting No (because he felt that there should be a comprehensive plan for future park developments that includes more than just pool improvements). Resolution No. 2013-02 confirming the Declaratory Resolution No. 2013-02 was passed by the Lebanon Board of Park Commissioners on June 5, 2013, with Mike Burns, Jerry Freeman, Karen Galvin, Laurie Gross, and Michelle Thomas voting Yes (Derek Warren was absent). Resolution No. 2013-03 to approve a $2 million bond issue for the new aquatic center was also passed by the Lebanon Board of Park Commissioners on June 5, 2013, with Mike Burns, Jerry Freeman, Karen Galvin, Laurie Gross, and Michelle Thomas voting Yes (Derek Warren was absent).

Lebanon Board of Park Commissioners Contract for a new Lebanon Memorial Park Aquatic Center

The $2 million bond issue referenced in Resolution No. 2013-01 above is supposed to pay for all of the following: (1) demolition of the existing Lebanon Memorial Park swimming pool; (2) construction and installation of a pool vessel, pool deck, fence, utilities, and new mechanical building; (3) $245,000 in HWC Engineering expenses; (4) publication costs; (5) legal expanses; (6) accounting expenses; (7) bonds issuance costs; and (8) incidental expenses.

The stated intention of the Board is to start with a “basic facility” and add improvements over time. Various water toy features can be added over time. Also, a separate wave pool could be constructed adjacent and outside the existing pool fence.

As outlined in the HWC Engineering Contract Addendum included below, the initially proposed $4 million aquatics center project has been downsized to exclude a wave pool, improvements to the existing pool house, site improvements outside the pool fence, a new concessions building at Lebanon Memorial Park, and a splash pad at Abner Longley Park.

The new $2 million Lebanon Memorial Park Swimming Pool will include a new beach entry, open leisure pool area, pool deck equipment, a water slide with a splash down area, a toy structure, and an 8-foot wide “Lazy River.” The open leisure pool area will accommodate swim lessons and water walking, and can function as a lap pool if the "lily pad" foam board walk area is unhooked from the end of the pool area. Pool construction will begin at the end of the 2013 pool season, and is expected to take ten months and be completed May 2014.

Section 2 of Resolution No. 2013-01 above states that "The estimated aggregate cost of the Project, including all necessary expenses such as engineering expenses, publication costs, legal expenses, accounting expenses and other necessary costs of issuance, is in an amount not to exceed $2,000,000." However, Item 4a on Page 4 of Exhibit A in the HWC Engineering Contract Addendum (see below) states "The scope of services is based on a construction budget (excluding non-construction costs) of $2,000,000." It appears that careful oversight will be needed to make certain the total cost of the new Lebanon Memorial Park aquatic center does not exceed $2,000,000. It was indicated at the June 5, 2013, Lebanon Board of Park Commissioners meeting that construction costs will be $1.6 million, with $245,000 in engineering costs, $20,000 in bond underwriting costs, and $135,000 to cover the costs of bond issuance and contingencies.

![]() Watchdog Indiana Home Page

Watchdog Indiana Home Page

![]() Watchdog Lebanon Home Page

Watchdog Lebanon Home Page

This page was last updated on 04/26/15 .