OUTCOME: Transportation Infrastructure Funding

![]() Watchdog Indiana Home Page

Watchdog Indiana Home Page

![]() Watchdog

Indiana Transportation Infrastructure Funding Plan

Watchdog

Indiana Transportation Infrastructure Funding Plan ![]() 2017

Transportation Infrastructure Funding

2017

Transportation Infrastructure Funding ![]() Indiana

Fuel Taxes History

Indiana

Fuel Taxes History ![]() Indiana

Personal Income History

Indiana

Personal Income History ![]() Indiana

State Reserves History

Indiana

State Reserves History ![]() Indiana

State Revenue Forecasts History

Indiana

State Revenue Forecasts History ![]() ACT

NOW: Transportation Infrastructure Funding

ACT

NOW: Transportation Infrastructure Funding

The 2017 Indiana General Assembly addressed the topic of transportation infrastructure funding with Indiana House Bill 1002. The Indiana House of Representatives passed HB 1002 by a 69-29 vote on April 21, 2017. The Indiana Senate passed HB 1002 by a 37-12 vote on April 22, 2017. Governor Eric Holcomb signed HB 1002 into law on April 27, 2017.

It has been reported that HB 1002 will provide in Fiscal Year 2018 an additional $357 million in state funding and $260 million in local funding to maintain and improve the state's roads and bridges. This funding will apparently continue to increase year-over-year, reaching $1.2 billion by 2024 - with about $850 million for state transportation infrastructure and $350 million for local transportation infrastructure.

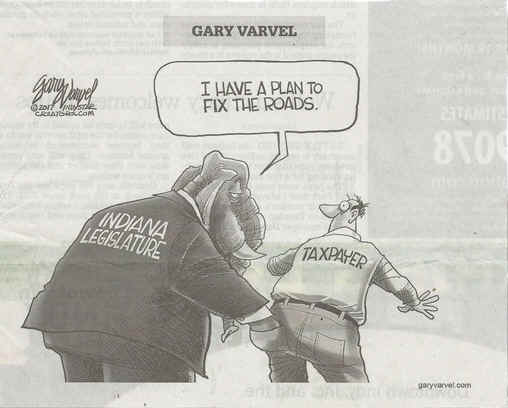

The following editorial cartoon pretty well summarizes the provisions included in HB 1002:

HB 1002 has sixty major provisions. These major provisions are separated below into three groups - Taxpayer UNfriendly, Taxpayer Neutral, and Taxpayer Friendly.

The twenty-seven HB 1002 provisions listed next are Taxpayer UNfriendly. These provisions represent an unnecessary elephantine grab of money out of the pockets of individual Hoosier taxpayers.

(1) Fiscal Year 2019 Expected Gasoline Tax

Rate Increase to $0.29 per gallon.

(2) Fiscal Year 2020 Expected Gasoline Tax Rate

Increase to $0.30 per gallon.

(3) Fiscal Year 2021 Expected Gasoline Tax Rate

Increase to $0.31 per gallon.

(4) Fiscal Year 2022 Likely Gasoline Tax Rate

Increase to $0.32 per gallon,

(5) Fiscal Year 2023 Likely Gasoline Tax Rate

Increase to $0.33 per gallon.

(6) Fiscal Year 2024 Likely Gasoline Tax Rate

Increase to $0.34 per gallon.

(7) Fiscal Year 2025 Likely Gasoline Tax Rate

Increase to $0.35 per gallon.

(8) Fiscal Year 2019 Expected Special Fuel Tax

Rate Increase to $0.27 per gallon.

(9) Fiscal Year 2020 Expected Special Fuel Tax Rate

Increase to $0.28 per gallon.

(10) Fiscal Year 2021 Expected Special Fuel Tax Rate

Increase to $0.29 per gallon.

(11) Fiscal Year 2022 Likely Special Fuel Tax Rate

Increase to $0.30 per gallon.

(12) Fiscal Year 2023 Likely Special Fuel Tax Rate

Increase to $0.31 per gallon.

(13) Fiscal Year 2024 Likely Special Fuel Tax Rate

Increase to $0.32 per gallon.

(14) Fiscal Year 2025 Likely Special Fuel Tax Rate

Increase to $0.33 per gallon.

(15) Fiscal Year 2019 Expected Motor Carrier

Surcharge Tax Rate Increase to $0.22 per gallon.

(16) Fiscal Year 2020 Expected Motor Carrier Surcharge Tax

Rate Increase to $0.23 per gallon.

(17) Fiscal Year 2021 Expected Motor Carrier Surcharge Tax

Rate Increase to $0.24 per gallon.

(18) Fiscal Year 2022 Likely Motor Carrier Surcharge Tax

Rate Increase to $0.25 per gallon.

(19) Fiscal Year 2023 Likely Motor Carrier Surcharge Tax

Rate Increase to $0.26 per gallon.

(20) Fiscal Year 2024 Likely Motor Carrier Surcharge Tax

Rate Increase to $0.27 per gallon.

(21) Fiscal Year 2025 Likely Motor Carrier Surcharge Tax

Rate Increase to $0.28 per gallon.

Details regarding why these twenty-one HB 1002 provisions are Taxpayer

UNfriendly can be found under HB 1002 Component #2 at http://www.finplaneducation.net/2017_transportation_funding.htm.

(22) Transportation Infrastructure Improvement Fee. Effective January 1, 2018, HB 1002 will impose a new $15 annual transportation infrastructure improvement fee that applies to all Indiana motor vehicle registrations EXCEPT for (a) trailers, (b) semitrailers, (c) nonmotive recreational vehicles, (d) special machinery, (e) vehicles registered as military vehicles, (f) vehicles registered as collector vehicles, (g) motor-driven cycles, and (h) trucks, tractors used with a semitrailer, and for-hire buses with a declared gross weight greater than 26,000 pounds. Revenue from the new transportation infrastructure improvement fee will be deposited in the Local Road and Bridge Matching Grant Fund. Increasing revenue available to the Local Road and Bridge Matching Grant Fund should increase grants made annually by the Indiana Department of Transportation. The new $15 fee is expected to generate approximately $85.1 million in annual revenue for the Local Road and Bridge Matching Grant Fund, with $42.6 M being received in Fiscal Year 2018. Details regarding why this HB 1002 provision is Taxpayer UNfriendly can be found under HB 1002 Component #4 at http://www.finplaneducation.net/2017_transportation_funding.htm.

(23) Special Fuel State Gross Retail Tax Exemption. HB 1002 exempts the sale of special fuel from the state gross retail tax effective July 1, 2017, which is expected to decrease revenue to the state General Fund. What this means is that carriers and farmers who operate commercial motor vehicles will no longer have to pay the 7% state Sales Tax on diesel fuel purchases. The Sales Tax savings to commercial carriers and farmers will be about $0.14. per gallon ($2.409 per gallon sales price at the diesel fuel pump, less the $0.243 per gallon federal diesel fuel tax, less the $0.16 per gallon state diesel fuel tax, multiplied by 0.07). The Fiscal Year 2018 net state tax increase on diesel fuel purchases will only be $0.06 per gallon (the $0.10 per gallon increase in the Special Fuel Tax, plus the $0.10 per gallon increase in the Motor Carrier Surcharge Tax, less the $01.14 per gallon Sales Tax exemption). The state Gasoline Tax paid by individual Hoosier motorists will increase $010 per gallon in Fiscal Year 2018. It is Taxpayer UNfriendly that the fuel tax rate paid by car drivers will go up significantly more than the fuel tax rate paid by commercial carriers and farmers because heavy commercial motor vehicles damage our roads and bridges more than lighter-weight passenger cars.

(24) Toll Roads. HB 1002 removes the current statute requiring approval from the General Assembly to toll portions of certain interstates. However, HB 1002 provides that before the Governor, the Indiana Department of Transportation (INDOT), the Indiana Finance Authority (IFA), or an operator may enter into an agreement for the financing, construction, maintenance, or operation of a toll road project, the proposed agreement must first be reviewed by the state Budget Committee (whose members are currently State Representative Tim Brown, State Senator Luke Kenley, State Representative Terry Goodin, State Senator Karen Tallian, and State Budget Director Brian E. Bailey). INDOT is required by HB 1002 to seek a Federal Highway Administration waiver to toll interstate highways. In addition, HB 1002 mandates that the first toll lanes established on an interstate highway must be located at least 75 miles from an interstate highway or bridge on which travel is subject to tolling as of July 1, 2017. There must be a public comment period, and required replies to the public comments, for a toll road project by INDOT or a tollway project carried out using a public private partnership. HB 1002 further requires INDOT to engage an outside consulting firm to conduct a feasibility study on tolling the interstate highways (including revenue projections based on an analysis of optimal tolling rates, vehicle counts and types by state of registration, and traffic diversion). A written report on the feasibility study must be delivered before November 1, 2017, to the Governor, the state Legislative Council, and the state Budget Committee. If, after review of the feasibility study, the Governor determines that tolling is the best means of achieving major interstate system improvements in Indiana, the Governor must create a strategic plan for tolling interstate highways and submit the strategic plan to the state Budget Committee before December 1, 2018. Details regarding why these HB 1002 toll road provisions are Taxpayer UNfriendly can be found under HB 1002 Component #8 at http://www.finplaneducation.net/2017_transportation_funding.htm.

(25) Electric Vehicle Supplemental Registration Fee Increases. HB 1002 increases the new $150 supplemental registration fee for electric vehicles every five years beginning January 1, 2023, based on an index factor like that used to annually increase the fuel tax rates. It is Taxpayer UNfriendly to increase the supplemental registration fee every five years because it is apparent that the annual index factor that would be used to increase the fee is actually KEEP-YOUR-GOVERNMENT-FAT & HAPPY Index Factor that would provide additional revenues much in excess of overall Consumer Price Index inflation increases: see http://www.finplaneducation.net/indiana_personal_income.htm.

(26) Hybrid Vehicle Supplemental Registration Fee Increases. HB 1002 increases the new $50 supplemental registration fee for hybrid vehicles every five years beginning January 1, 2023, based on an index factor like that used to annually increase the fuel tax rates. It is Taxpayer UNfriendly to increase the supplemental registration fee every five years because it is apparent that the annual index factor that would be used to increase the fee is actually a KEEP-YOUR-GOVERNMENT-FAT & HAPPY Index Factor that would provide additional revenues much in excess of overall Consumer Price Index inflation increases: see http://www.finplaneducation.net/indiana_personal_income.htm.

(27) Municipal Excise Surtax and Wheel Tax. Effective upon passage, HB 1002 allows the population for eligible municipalities to impose a Municipal Excise Surtax and Wheel Tax to be lowered to 5,000 from 10,000. Details regarding why this HB 1002 provision is Taxpayer UNfriendly can be found under HB 1002 Component #20 at http://www.finplaneducation.net/2017_transportation_funding.htm.

The twenty-six HB 1002 provisions listed next are Taxpayer Neutral.

(28) Gasoline Use Tax Distribution Changes. The Gasoline Use Tax is a

7% sales tax on gasoline purchases made at the gas pump. Listed next by state

Fiscal Year is how the Gasoline Use Tax revenues are distributed - the

changes made by HB 1002 are highlighted in bold blue.

Fiscal Year 2017: 14.286% deposited in the motor vehicle highway account,

85.714% deposited in the state general fund

Fiscal Year 2018: 14.286% deposited in the motor vehicle highway account, 14.286%

deposited in the local road and bridge matching grant fund, 71.428% deposited in

the state general fund

Fiscal Year 2019: 14.286% deposited in the motor vehicle highway account,

21.429% deposited in the local road and bridge matching grant fund,

64.285% deposited in the state general fund

Fiscal Year 2020: 14.286% deposited in the motor vehicle highway account,

21.429% deposited in the local road and bridge matching grant fund, 2.142%

state highway fund, 8.568%

special transportation

flexibility fund, 53.575%

deposited in the state general fund

Fiscal Year 2021: 14.286% deposited in the motor vehicle highway

account, 21.429% deposited in the local road and bridge matching grant fund, 8.568%

state highway fund, 12.852%

special transportation

flexibility fund, 42.865%

deposited in the state general fund

Fiscal Year 2022: 14.286% deposited in the motor vehicle highway

account, 21.429% deposited in the local road and bridge matching grant fund, 19.278%

state highway fund, 12.852%

special transportation

flexibility fund, 32.155%

deposited in the state general fund

Fiscal Year 2023: 14.286% deposited in the motor vehicle highway

account, 21.429% deposited in the local road and bridge matching grant fund, 34.272%

state highway fund, 8.568%

special transportation

flexibility fund, 21.445%

deposited in the state general fund

Fiscal Year 2024: 14.286% deposited in the motor vehicle highway

account, 21.429% deposited in the local road and bridge matching grant fund, 53.55%

state highway fund, 10.735%

deposited in the state general fund

Fiscal Year 2025 and thereafter: 14.286% deposited in the motor

vehicle highway account, 21.429% deposited in the local road and bridge matching

grant fund, 64.285%

deposited in the state highway fund

Gasoline Use Tax revenue that would

have otherwise been deposited in the

state General Fund is transferred to the State Highway Fund and a new Special

Transportation Flexibility Fund

beginning in Fiscal Year 2020. After Fiscal Year 2023, the Special

Transportation Flexibility Fund will no longer receive a distribution of

Gasoline Use Tax revenue and all

previous distributions to the state General Fund will instead be deposited in the

State Highway Fund. The

new nonreverting Special Transportation Flexibility

Fund is funded from a portion of the Gasoline Use Tax between Fiscal Year 2020

and Fiscal Year 2023. A total of

$235.1 million is expected to be deposited in the Flexibility Fund during that

time period. Revenue deposited in

the Flexibility Fund is to be transferred to the State Highway Fund biannually

unless otherwise specified by the

Governor and the state Budget Committee (whose members are currently State

Representative Tim Brown, State Senator Luke Kenley, State Representative Terry

Goodin, State Senator Karen Tallian, and State Budget Director Brian E. Bailey).

The first transfer of $21.9 million of revenue is expected to occur January

2021. Money in the fund that is

not transferred to the State Highway Fund is earmarked for K-12 education,

health care, or child services if

the Governor feels federal or state funding is insufficient to support those

programs.

All of the 7% Gasoline Use Tax revenue on fuel pump sales should

have been immediately dedicated starting with Fiscal Year 2018 to the

state Motor Vehicle Highway Account, the state Local Road and Bridge Matching

Grant Fund, and the State Highway Fund. Some legislators express concern that

immediately dedicating all of the Gasoline Use Tax to transportation

infrastructure needs would result in the state’s General Fund having

problematic shortfalls. However, there are numerous ways to

manage the proposed state General Fund revenue reductions without impacting the

delivery of necessary services. For example, use of the Governor’s

reversion authority to NOT spend unneeded state General Fund budgeted amounts

has averaged $232.1 million the past six Fiscal Years from 2012 through 2017.

Also, reducing the state's Fiscal Year 2017 total cash reserves of $1.73060

billion to the prudent Fiscal Year 2018 total state cash reserves of $1.55882

billion would free up $171.8 million for new General Fund spending in Fiscal

Year 2018. And, the latest forecast for the state General Fund shows an increase

of $420.9 million in Fiscal Year 2018 and $592.6 million in Fiscal Year 2019.

(29) Fiscal Year 2018 Gasoline Tax Rate Increase to $0.28 per gallon

(from $0.18 per gallon).

(30) Fiscal Year 2018 Special Fuel Tax Rate Increase to $0.26 per gallon

(from $0.16 per gallon.

(31) Fiscal Year 2018 Motor Carrier Surcharge Tax Rate Increase to $0.21

per gallon (from $0.11 per gallon).

Details regarding why these three HB 1002 provisions are Taxpayer Neutral

can be found under HB 1002 Component #1 at http://www.finplaneducation.net/2017_transportation_funding.htm.

(32) Electric Vehicle Supplemental Registration Fee. HB 1002 requires a person who registers an electric vehicle to pay a new supplemental annual registration fee of $150 effective January 1, 2018, until January 1, 2023. Revenue from this fee will be deposited in the Local Road and Bridge Matching Grant Fund. This new fee is Taxpayer Neutral because electric vehicle owners should pay their “fair share” to help build and maintain the roadways and bridges that they use.

(33) Hybrid Vehicle Supplemental Registration Fee. HB 1002 requires a person who registers a hybrid vehicle to pay a new supplemental annual registration fee of $50 effective January 1, 2018, until January 1, 2023. Revenue from this fee will be deposited in the Local Road and Bridge Matching Grant Fund. This new fee is Taxpayer Neutral because hybrid vehicle owners should pay their “fair share” to help build and maintain the roadways and bridges that they use.

(34) Motor Carrier Surcharge Tax Change. Effective July 1, 2017, HB 1002 requires individuals who operate personal diesel vehicles to pay the Motor Carrier Surcharge Tax at diesel fuel pumps in the state. The Motor Carrier Surcharge Tax is a true user fee in that the amount of money paid as a driver is directly proportionate to the amount of fuel consumed, which is directly proportional to the amount of driving done. Diesel car drivers should pay their fair share to maintain and improve the state's transportation infrastructure.

(35) Local Road and Bridge Matching Grant Fund Changes. HB 1002 bill increases revenue deposited in the fund annually as follows: $46.2 million in Fiscal Year 2018, $93.2 million in Fiscal Year 2019, $94.4 million in Fiscal Year 2020, and $95.7 million in Fiscal Year 2021. HB 1002 also allows local units of government to (a) use any money authorized for local road or bridge projects to meet the local match requirements and (b) aggregate across multiple jurisdictions for the purposes of drawing down a larger match from the state. Additionally, HB 1002 decreases the local match requirement from 50% of a project’s cost to 25% for counties with populations less than 50,000 and cities and towns with populations less than 10,000. This HB 1002 provision would be Taxpayer Friendly IF the local match requirement for all counties, cities, and towns was lowered from 50% to 25% - it is absurdly unfair for taxpayers in counties with populations more than 50,000 and in cities and towns with populations more than 10,000 to have a higher local match requirement while paying the same new Transportation Infrastructure Improvement Fee, Electric Vehicle Supplemental Registration Fee, and Hybrid Vehicle supplemental Registration Fee as taxpayers in smaller localities.

(36)

Annual Registration Fee Increase to $372 from $300 for a truck, a tractor

used with a semitrailer, or a for-hire bus with a declared gross weight greater

than 26,000 pounds and equal to or less than 36,000 pounds.

(37)

Annual Registration Fee Increase to $624 from $504 for a truck, a tractor

used with a semitrailer, or a for-hire bus with a declared gross weight greater

than 36,000 pounds and equal to or less than 48,000 pounds.

(38)

Annual Registration Fee Increase to $900 from $720 for a truck, a tractor

used with a semitrailer, or a for-hire bus with a declared gross weight greater

than 48,000 pounds and equal to or less than 66,000 pounds.

(39)

Annual Registration Fee Increase to $1,200 from $960 for a truck, a tractor

used with a semitrailer, or a for-hire bus with a declared gross weight greater

than 66,000 pounds and equal to or less than 78,000 pounds.

(40)

Annual Registration Fee Increase to $1,692 from $1,356 for a truck, a

tractor used with a semitrailer, or a for-hire bus with a declared gross weight

greater than 78,000 pounds.

These heavy vehicles annual registration fee increases

(which include farm vehicles) are Taxpayer Neutral because heavy vehicles cause

a disproportionate share of damage to roads and bridges compared to lighter

vehicles.

(41) International Registration Plan Fee Increase. HB 1002 increases registration fees for International Registration Plan (IRP) vehicles with a declared gross weight of 26,000 lbs. This provision could generate approximately $22 million in additional IRP revenue per year, which will be deposited in the Motor Vehicle Highwat Account. Increasing IRP registration fees could also impact the number of IRP vehicles that are domiciled in the state. To the extent that the number of IRP domiciled vehicles decreases, the state could experience revenue losses from other sources of revenue including, but not limited to, new vehicle registration fees, title fees, cab card fees, wheel taxes, and public safety fees. These heavy vehicles annual registration fee increases are Taxpayer Neutral because heavy vehicles cause a disproportionate share of damage to roads and bridges compared to lighter vehicles.

(42) Annual Trailer Renewal Fee Elimination. HB 1002 provides that the owner of a semitrailer permanently registered in Indiana does not pay an annual registration renewal fee. Currently, the Indiana Department of Revenue does not collect the $8.75 renewal fee for permanent semitrailers registered under the International Registration Plan, but the BMV does for permanent semitrailers registered in the state. Under HB 1002l, renewal of permanent semitrailers and farm permanent semitrailers will no longer be subject to the $8.75 fee that became effective 2017. The revenue loss from these fees is estimated to be approximately $470,800 per year starting in Fiscal Year 2018. This HB 1002 provision is Taxpayer Neutral because the annual registration fees are increasing for heavy vehicles, which cause a disproportionate share of damage to roads and bridges compared to lighter vehicles.

(43) Annual Alternative Fuel Decal Fee Increase to $150 from $100 for

a passenger motor vehicle, truck, or bus, the declared gross weight of which is

equal to or less than 9,000 pounds, that is owned by a public or private

utility.

(44) Annual Alternative Fuel Decal Fee Increase to $150 from $100 for a

recreational vehicle that is owned by a public or private utility.

(45) Annual Alternative Fuel Decal Fee Increase to $262.50 from $175

for a truck or bus, the declared gross weight of which is greater than 9,000

pounds but equal to or less than 11,000 pounds, that is owned by a public or

private utility.

(46) Annual Alternative Fuel Decal Fee increase to $375 from $250 for an

alternative fuel delivery truck powered by alternative fuel, the declared gross

weight of which is greater than 11,000 pounds.

(47) Annual Alternative Fuel Decal Fee Increase to $450 from $300 for a

truck or bus, the declared gross weight of which is greater than 11,000 pounds,

except an alternative fuel delivery truck.

(48) Annual Alternative Fuel Decal Fee Increase to $750 from $500 for a

tractor designed to be used with a semitrailer.

Details regarding why these six HB 1002 provisions are Taxpayer Neutral can be

found under HB 1002 Component #3 at http://www.finplaneducation.net/2017_transportation_funding.htm.

(49) Motor Vehicle Highway Account Distribution Changes. Effective July 1, 2017, HB 1002 provides that the percentage of the amounts distributed to the state and to the local units from the Motor Vehicle Highway Account changes incrementally each fiscal year from 53% for the state and 47% for the local units under current law to 60% for the state and 40% for the local units after June 30, 2022. This HB 1002 provision is Taxpayer Neutral because, after accounting for changes in off-the-top distributions of gasoline and special fuel tax revenue as well as changes to the distribution of local revenue received from the Motor Vehicle Highway Account, HB 1002 is expected to increase net revenue received by local units of government.

(50) Motor Vehicle Highway Account Local Use Changes. Effective July 1, 2017, HB 1002 eliminates the authority for cities and towns to use distributions from the Motor Vehicle Highway Account (MVHA) for: (a) the painting of structures and objects; and (b) law enforcement. HB 1002 also requires counties, cities, and towns to use at least 50% of the MVHA distributions for the construction, reconstruction, and maintenance of highways. These HB 1002 changes are Taxpayer Neutral because local expenditures on highways could increase while local expenditures on bridges might be reduced in some instances.

(51) Motor Carrier Civil Penalties Assessment Procedures. Effective July 1, 2017, HB 1002 amends the assessment procedures for motor carrier civil penalties under Indiana Code 9-20-18-14.5. The Indiana Department of Revenue's notice of proposed assessment under IC 6-8.1-5-1 would be presumptively valid. A person against whom a civil penalty is imposed under this provision could protest the penalty and request an administrative hearing. If a hearing is requested, the department must hold an administrative hearing at which the person has an opportunity to present information as to why the civil penalty should not be assessed. Details regarding why this HB 1002 provision is Taxpayer Neutral can be found under HB 1002 Component #10 at http://www.finplaneducation.net/2017_transportation_funding.htm.

(52) Aviation Fuel Excise Tax Increase. HB 1002 increases the aviation fuel excise tax to $0.20 per gallon from $0.10 per gallon effective July 1, 2017. It is Taxpayer Neutral that the additional $1.7 million revenue is deposited in the Airport Development Grant Fund for use by the Indiana Department of Transportation to (a) provide matching airport capital improvement grants and (b) allow the state to leverage Federal Aviation Administration grant funds from the Airport Improvement Program.

(53) Tax Revenue Distribution Changes. HB 1002 eliminates from the distribution of the gasoline and special fuel taxes: (a) the $0.01 going to the State Highway Fund; (b) the $0.01 going to counties, cites, and towns through the Motor Vehicle Highway Account; and (c) off-the-top distributions to a special distribution account. These tax revenue distribution changes are Taxpayer Neutral because HB 1002 in its entirety is expected to increase net revenue received by local units of government.

The seven HB 1002 provisions listed next are Taxpayer Friendly. These provisions are results-oriented, compassionate, and fiscally responsible.

(54) Motor Carrier Surcharge Tax Payment Change. Effective July 1, 2017, HB 1002 requires the Motor Carrier Surcharge Tax to be paid at the pump instead of through quarterly filings made with the Indiana Department of Revenue. As a result, the state is expected to collect an additional $20 million annually from motor carriers, which includes $10 million in previously uncollected tax revenue and an additional $10 million from the tax rate increases contained in HB 1002. It is Taxpayer Friendly to have the Motor Carrier Surcharge Tax paid at the pump instead of through quarterly DOR filings if motor carriers will more accurately pay their fair share of fuel tax.

(55) Motor Carrier Surcharge Tax Distribution Changes. Effective July 1, 2017, HB 1002 changes distributions of Motor Carrier Surcharge Tax revenue by (a) reducing the distribution to the Motor Carrier Regulation Fund from 9% to 4.5% and (b) increasing distributions to the Motor Vehicle Highway Account and the State Highway Fund from 45.5% to 47.75% for both funds. The distribution change, after accounting for tax increases in HB 1002l, is not expected to have a significant impact on revenue the Motor Carrier Regulation Fund receives annually, but will increase revenue to the Motor Vehicle Highway Account and the State Highway Fund.

(56) Transportation Funding Exchange Program Changes. Effective July 1, 2017, HB 1002 makes changes to the Transportation Funding Exchange Program between the state and counties and municipalities. The Indiana Department of Transportation (INDOT) retains discretion to select local projects for participation in the Exchange Program and can exchange up to 100% of the local share with state funding, provided the local unit provides a 20% match. HB 1002 also sets aside 25% of INDOT’s overall annual federal program for local projects funded with federal dollars. As a result, an estimated $249 million in State Highway Funds would be set aside for local fund swaps under HB 1002. The $249 million in set-aside funds does not necessarily represent a state expenditure increase as (a) local government units and metropolitan planning organizations will decide if they want to utilize the state funding swap, (b) local units are required to provide a 20% match of swapped funds, and (c) federal funds swapped for state funds could be utilized for state road projects with the state required to provide the 20% match required by the Federal Highway Administration. The maximum estimated State Highway Funds that would be used from the set-aside (after deducting the local match requirement) is approximately $200 million, with the state being required to expend approximately $49 million in State Highway Funds under the match to use the $249 million in federal funds. Details regarding why this HB 1002 provision is Taxpayer Friendly can be found under HB 1002 Component #16 at http://www.finplaneducation.net/2017_transportation_funding.htm.

(57) Railroad Crossing Remediation Projects. Effective July 1, 2017, HB 1002 permits the Indiana Department of Transportation (INDOT) to approve certain railroad crossing remediation projects, and would authorize the Indiana Finance Authority (IFA) to finance approved projects subject to a maximum annual debt service limit of $10,000,000. To be approved, a railroad crossing remediation project would have to be at a state highway and be at a stage of critical need. The IFA would be authorized to obtain bonds for railroad crossing remediation projects until Fiscal Year 2025. HB 1002 would also change the off-the-top distribution of Gasoline Tax revenue deposited in the State Highway Road Construction Improvement Fund (SHRCIF) from a 11.11 percent distribution to a flat $70 million annual amount. This distribution change is expected to increase revenue to the SHRCIF, which would be used to make payments on bonds obtained for state highway railroad crossing remediation projects. Issuing Indiana Finance Authority bonds the next seven years to improve state highway railroad crossings that are at a stage of critical need is Taxpayer Friendly.

(58) Weigh-In-Motion Pilot Program. HB 1002 establishes the Weigh-In-Motion Pilot Program. The Indiana Department of Transportation (INDOT) reports that currently there are no estimated state costs to operate the Pilot Program. The Pilot Program is expected to be provided by a third-party vendor, with INDOT, the Indiana State Police, and the Indiana Department of Revenue providing minimal staffing support. Any increases in workload are expected to be accomplished under current funding and resource levels. Details regarding why this HB 1002 provision is Taxpayer Friendly can be found under HB 1002 Component #11 at http://www.finplaneducation.net/2017_transportation_funding.htm.

(59) State and Local Bridge Prioritization and Condition Metrics: Under HB 1002, the Indiana Department of Transportation (INDOT) is charged with (a) establishing state and local metrics to evaluate infrastructure needs and (b) developing a state and local road and bridge prioritization system based on safety, congestion, environment, regional and state economic contribution, potential intermodal connectivity, and total cost of ownership. Requiring INDOT to institute the condition and prioritization metrics, including the appointment of two economic professionals and two engineers, is expected to be accomplished with existing resources and funding levels. If it can be accomplished using existing INDOT resources and funding levels, it would be Taxpayer Friendly have INDOT establish consistent methods to evaluate the condition of state and local roads and bridges and also develop a prioritization system to improve the state and local roads and bridges.

(60) Centralized Electronic Statewide Asset Management Database. Effective July 1, 2017, HB 1002 appropriates $250,000 of Motor Vehicle Highway Account (MVHA) funds annually to the Indiana Department of Transportation for the Local Technical Assistance Program to develop and maintain a centralized electronic statewide asset management database. As a result, the State Highway Fund would receive approximately $133,000 less revenue from the MVHA and local units of government would receive approximately $117,000 less in local MVHA revenue per year. Developing and maintaining a centralized electronic statewide asset management database would be Taxpayer Friendly IF timely information and "what if" analyses are provided to help make cost-effective resource allocation decisions regarding the state’s transportation infrastructure. It will be interesting to see if there is significant “conflict” between the priorities developed from using the centralized electronic statewide asset management database and the allocation decisions included in the various county, city, and town asset management plans.

![]() Watchdog Indiana Home Page

Watchdog Indiana Home Page

![]() Watchdog

Indiana Transportation Infrastructure Funding Plan

Watchdog

Indiana Transportation Infrastructure Funding Plan ![]() 2017

Transportation Infrastructure Funding

2017

Transportation Infrastructure Funding ![]() Indiana

Fuel Taxes History

Indiana

Fuel Taxes History ![]() Indiana

Personal Income History

Indiana

Personal Income History ![]() Indiana

State Reserves History

Indiana

State Reserves History ![]() Indiana

State Revenue Forecasts History

Indiana

State Revenue Forecasts History ![]() ACT

NOW: Transportation Infrastructure Funding

ACT

NOW: Transportation Infrastructure Funding

This page was last updated on 05/06/17.