Boone County Local Income Tax

![]() Watchdog Indiana Home Page

Watchdog Indiana Home Page

![]() Watchdog Lebanon Home Page

Watchdog Lebanon Home Page

![]() Boone

County Sheriff 2016 Business Plan

Boone

County Sheriff 2016 Business Plan ![]() Bait

& Switch

Bait

& Switch ![]() Boone

County Police Departments

Boone

County Police Departments

Overview

The 2016 Boone County Local Income Tax rate is 1.00% of the state adjusted gross income of individual taxpayers residing in Boone County. The Boone County Income Tax Council is empowered to increase the Boone County Local Income Tax rate from 1.00% up to 2.50%. A Boone County Local Income Tax rate increase will be effective January 1, 2017, if it is passed by the Boone County Income Tax Council before November 1, 2016.

Outcome

On October 11, 2016, a 0.50 percent increase in the Boone County Local Income Tax (to a total of 1.50%) was unanimously approved by the Boone County Tax Council. While five individuals voted no, majority rule placed every Boone County municipal government council in favor of the increase. The members in attendance of the Advance, Jamestown, Whitestown, and Zionsville town councils voted unanimously to approve the tax hike. The Boone County Council also voted unanimously to approve. The Ulen Town Board declined to participate. The Lebanon City Council voted 4-3 in favor, with Keith Campbell, John Copeland, Mike Kincaid, and Corey Kutz voting yeas - Dan Fleming, Jeremy Lamar, and Dick Robertson voted no. Thorntown's 2-2 tie vote was broken with town clerk John Gillian voting yes - Mark Garing and Donnie Johnson also voted yes while Koren Gray and Larry Truitt voted no. Lebanon Mayor Matt Gentry and Zionsville Mayor Tim Haak declined to veto the approval of their respective councils.

Public testimony was mostly disregarded by the Boone County Tax Council to please vote NO on the 50% Local Income Tax increase for the following 14 reasons:

(1) It would worsen the food insecurity of low income county households,

(2) Higher income county households would have less money for the high costs of continuing education and dignified retirements,

(3) It is twice what the Sheriff needs for his Business Plan (see Boone County Sheriff 2016 Business Plan),

(4) Much of the excessive increase would NOT be used to pay for new AND necessary spending by other county police and fire departments (see Bait & Switch),

(5) The county’s ample cash reserves and future revenue increases from the current LIT can be used to quickly phase in the higher and medium priority components of the Sheriff’s Business Plan WITHOUT a tax increase,

(6) Voting NO on the 50% LIT increase allows you to come back next year and decide if it makes sense to impose a more reasonable 25% LIT increase,

(7) The Sheriff is over-zealous in refusing to prioritize his Business Plan components so the Boone County Council can best balance his most important needs against other county priorities,

(8) A Criminal Interdiction Team can be immediately established WITHOUT a LIT increase,

(9) Increasing the number of self-initiated calls for service by hiring 8 more Merit Deputies is not expected to significantly increase the number of serious criminal cases filed by the Sheriff’s Office because there is less criminal activity in the county rural areas where the Sheriff’s Office is the lead law enforcement agency than there is in the urban areas of Lebanon, Zionsville, and Whitestown,

(10) The need to immediately hire 8 more Merit Deputies is lessened when one considers that Boone County exceeds the national average for the number of full-time officers with 111 full-time officers now serving in the seven Boone County police agencies (see Boone County Police Departments),

(11) The Sheriff wants to set aside $600,000 each year from the excessive 50% LIT increase for an unneeded Sheriff’s Rainy Day Emergency Fund and for future Boone County Jail expansions when this money could be better spent on meeting current county needs,

(12) It was UNETHICAL for carefully selected hired and elected public officials to meet behind closed doors to initiate the excessive 50% LIT increase by approving a public notice in the name of the Boone County Council WITHOUT the approval of the entire Boone County Council,

(13) Zionsville will receive $849,824 more revenue next year from the existing LIT WITHOUT the 50% increase, and this extra revenue can be used to phase in additional Zionsville police officers and firefighters – AND pay Boone County its fair share for having the Sheriff’s office provide supplemental police protection to Zionsville’s 60-square mile rural area, and

(14) Property tax caps have NOT resulted in ANY serious financial implications for our Boone County municipal and county government units that justify an excessive 50% LIT increase.

Local Income Tax Rate Increase: Taxpayers Impact

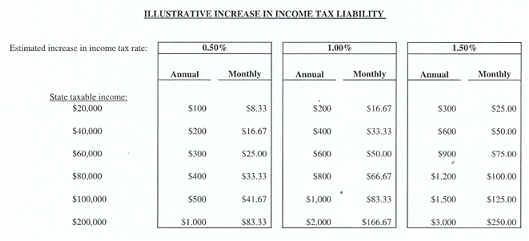

The table below shows how much more Local Income Tax will be taken out of the paychecks of selected individual taxpayers residing in Boone County if the tax rate increases by 0.50%, 1.00%, or 1.50% (from 1.00% now up to the maximum allowed 2.50%).

Local Income Tax Rate Increase: Allocation Options

Boone County Local Income Tax revenues can be allocated to Certified Shares, Public Safety, or Economic Development. Allocation decisions are made by the Boone County Income Tax Council.

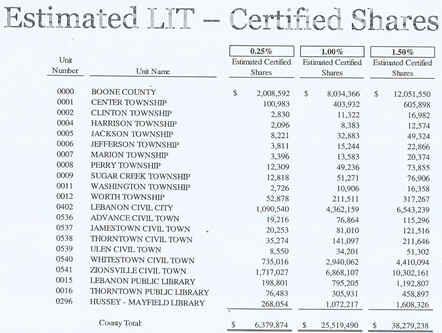

Certified Shares Option

Certified Shares allocations (1) can be used for any lawful purpose the same as for the former 1.00% County Option Income Tax, (2) will be distributed to all Boone County civil units that impose a property tax (except schools), and (3) may include the Boone County Solid Waste Management District if approved by the Boone County Income Tax Council.

Public Safety Option

Public Safety allocations are distributed to the county and Boone County municipalities. The allocations may be used to pay for (1) a police and law enforcement system to preserve public peace and order; (2) a firefighting and fire prevention system; (3) emergency ambulance services; (4) emergency medical services; (5) emergency action (as defined in IC 13-11-2-65); (6) a probation department of a court; (7) confinement, supervision, and services under a community corrections program; (8) a juvenile detention facility; (9) a juvenile detention center; (10) a county jail; (11) a communications system, an enhanced emergency telephone system, a PSAP (as defined in IC 36-8-16.7-20) that is part of the statewide 911 system. or the statewide 911 system; (12) medical and health expenses for jailed inmates and other confined persons; and (13) pension payments for any member or employee of a fire department, police department, and county sheriff.

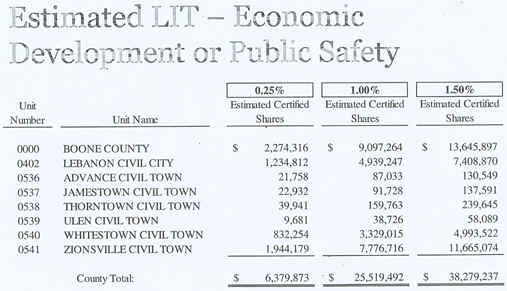

Economic Development Option

Economic Development allocations are distributed to the county and Boone County municipalities. The executive of the county and municipalities must adopt capital improvement plans that cover at least two years and include projects equaling at least 75% of the amount anticipated to be received. If a capital improvement plan is not adopted, the County Treasurer will retain the civil unit's distribution until a plan has been adopted. A county, city, or town may designate the county, city, or town as the recipient of all or a portion of its share.

Local Income Tax Rate Increase: Revenues Impact

The two tables below shows how much more Local Income Tax revenue that the Boone County civil units will receive if the tax rate increases increases by 0.25%, 1.00%, or 1.50% (from 1.00% now up to the maximum allowed 2.50%). The first table lists Local Income Tax revenue increases if the certified shares option is used to allocate the revenue increases. The second table lists Local Income Tax revenue increases if the public safety option or the economic development option is used to allocate the revenue increases.

Boone County Income Tax Council

The Boone County Income Tax Council is empowered to adopt, increase, decrease, or rescind the Boone County Local Income Tax.

The membership of the Income Tax Council consists of the Boone County Council and the fiscal body of each city or town that lies either partially or entirely within Boone County.

The Income Tax Council has a total of 100 votes. Every member of the Income Tax Council is allocated a percentage of the 100 votes that may be cast rounded to the nearest one hundredth (0.01). The vote percentage that a city or town is allocated for a year equals the same percentage that the population of the city or town bears to the population of the county. The vote percentage that the county is allocated for a year equals the same percentage that the population of all areas in the county not located in a city or town bears to the population of the county. It takes at least 51 votes of the Income Tax Council to adopt, increase, decrease, or rescind the Local Income Tax.

Any member of a county income tax council is permitted to present an ordinance for passage that would change the Local Income Tax. To do so, the member must pass a resolution to propose the ordinance to the Income Tax Council and distribute a copy of the proposed ordinance to the County Auditor. The County Auditor must treat any proposed ordinance as a casting of all that member's votes in favor of the ordinance, and the votes may not be changed for a year. The County Auditor must deliver copies of the ordinance to all members of the Income Tax Council within 10 days after receipt. Once a member receives a proposed ordinance from the County Auditor, the member must vote on it within thirty (30) days after receipt.

The Boone County Income Tax Council threatens the American concept of majority rule because it is possible for elected officials representing a minority of the county’s population to increase the county-wide Local Income Tax even if elected officials representing the majority of the county population vote NO.

The following allocation of the Boone County Income Tax Council votes (using the 2010 census counts from the U.S. Census Bureau) demonstrates the reality of this threat:The Lebanon City Council has seven members. Two members are elected at-large and five are elected from equally-populated districts. Each of the five Lebanon City Council members who is elected from a district represents 5.58% of the total Boone County population (27.88% divided by 5).

The Zionsville Town Council also has seven members, two of which are elected at-large and five are elected from equally-populated districts. Each of the five Zionsville Town Council members who is elected from a district represents 5.00% of the total Boone County population (25.00% divided by 5).

Four Lebanon City Council members elected from a district could pass an ordinance to increase the Local Income Tax. This tax-increasing ordinance could then be passed by four Zionsville Town Council members elected from a district. Even if every one of the remaining 29 county council and town council members in Boone County voted NO against the ordinance, the Local Income Tax would be imposed because it received 53 of the 100 county income tax council votes (28 votes from the Lebanon City Council and 25 votes from the Zionsville Town Council).

The four Lebanon City Council members who were elected from a district and voted to increase the Local Income Tax represent 22.32% of the county population (4 X 5.58%). The four Zionsville Town Council members who were elected from a district and voted to increase the Local Income Tax represent 20.00% of the county population (4 X 5.00%). Therefore, eight elected officials representing only 42.32% of the county population could increase the county-wide Local Income Tax even if the remaining 29 elected officials representing 57.68% of the county population voted NO.

![]() Watchdog Indiana Home Page

Watchdog Indiana Home Page

![]() Watchdog Lebanon Home Page

Watchdog Lebanon Home Page

![]() Boone

County Sheriff 2016 Business Plan

Boone

County Sheriff 2016 Business Plan ![]() Bait

& Switch

Bait

& Switch ![]() Boone

County Police Departments

Boone

County Police Departments

This page was last updated on 07/07/18 .